As experts ponder the future direction

of captives, it is the small to mid-sized players that they see as moving the captive industry over the next few years.

Captives continue to provide opportunities

Small to mid-sized companies are foreseen as a growth market

By Michael J. Moody, MBA, ARM

|

As experts ponder the future direction |

For the most part, captive formations began as a response to hardening market conditions in the mid-1960s. And they have continued to flourish during hard markets. Captives have frequently been viewed as only Fortune 500-type risk financing solutions. But things have changed dramatically over the past few years.

The use of captives has grown significantly beyond the Fortune 500 market. Worldwide, according to the latest figures from the Captive Insurance Company Association (CICA), there are now 5,230 captives. And many of these captives are made up of small to mid-sized organizations. And as experts ponder the future direction of captives, it is the small to mid-sized players that they see as moving the captive industry over the next few years. Most experts also agree that there are still many more organizations that will see the opportunities that captives can provide for their owners and, as a result, growth will continue into the foreseeable future.

Seizing opportunity

Corporate insurance buyers over the years have determined the value of captives and have found ways to utilize them in developing strategic risk financing programs. Once captive owners saw the numerous advantages that are associated with captives, they rarely returned to the conventional insurance market. If anything, they found additional, creative ways to utilize their captives. The current market turmoil will assure that this trend continues.

But captive owners were not the only ones to see the opportunities from this alternative risk transfer method. Movement to captives also provided opportunities for many types of service providers. Captives allowed their parents to unbundle needed services that were previously provided by a single insurance carrier. Critical insurance services such as administration/management, actuarial, legal, accounting, claims and loss control all had to be included in the captives operations. Many new service providers have sprung up over the past 20 years to meet the needs of captive owners. Today, specialized service providers are continuing to find new niches within the captive arena.

Domicile responds

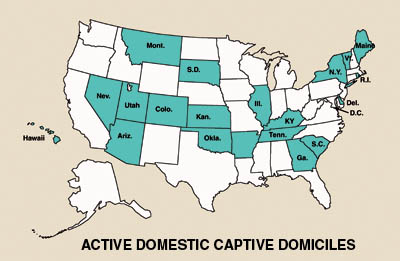

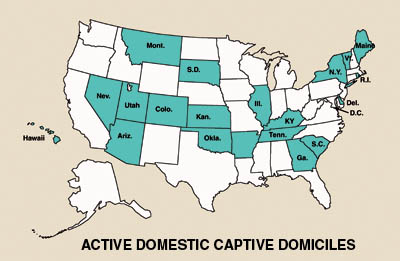

But it is not just the service providers that are battling for captive business. It’s also the domiciles themselves that are trying to attract prospective captive owners. Captives made their debut in 1962 when Bermuda passed its first captive regulations. In the United States, Colorado led the pack with enabling legislation that passed in 1972. Tennessee followed suit in 1978 and Virginia in 1980. Despite this effort, there was little interest in captive formation until the passage of the federal Risk Retention Act of 1981 (RRA).

Vermont was one of the first states to see the potential of RRA, and their state legislators passed the “Special Insurers Act” in 1981. A number of other states passed similar laws, but again limited interest from the corporate buyers slowed growth. This all changed during the hard market of 1986. In addition to market difficulties in many lines of coverage, Congress expanded the scope of the original RRA to include all liability coverages. This opened the door to an increasing interest in captive formation. A number of states began to see the value of attracting captives to their jurisdictions. The intervening years have seen a number of states pass enabling legislation, much of it modeled after the Vermont law.

At the time of this writing, 21 jurisdictions have captive laws that encourage organizations to form captives in their states. But why are states so interested in captive business? First and foremost, it is profitable. It has been reported that Vermont brings in over $21 million annually in premium taxes and fees from captive owners. Overall, the benefit to the Vermont economy—through payroll of service providers, goods and services to captive owners and tourism—is said to be more than $1 billion annually. That’s not bad for a non-polluting industry that is labor intensive and employs a number of local service providers. As a result, many states see the captive movement as the new “gold rush” and are working to find ways to attract potential owners.

Case in point

One state that has been successful in this effort is South Carolina. It came to the movement late, not passing legislation until 2000. The idea of becoming a captive domicile, according to Clayton Ingram, manager of business development, ART Services for the South Carolina Department of Insurance, grew out of an effort by the department to try and identify better ways to operate the department. Subsequent to passage of the original law, it has been revised several times in recent years, in response to owners’ requirements. South Carolina has been aggressive in attracting new captives and now has 119 captives. The state has done this by being a business-friendly domicile that has built flexibility into its laws.

As with many domiciles, South Carolina’s original law looked a lot like Vermont’s; but over the years, South Carolina has worked to differentiate itself from other domiciles. One area where this was done is with cell legislation which encourages group captives and rent-a-captives. Another area that was pioneered was securitizations via the passage of the Special Purpose Captive Insurance Act in 2002. At the present time, the majority of interest in this captive structure is coming from the life insurance industry. While South Carolina has already licensed a handful of special purpose financial captives, they believe that other industry segments will ultimately be interested in the potential offer by securitization. The South Carolina Insurance Department sees these captives as a growth area and has been quick to respond to their needs.

Domicile considerations

Worldwide, there are in excess of 60 captive domiciles. The domicile selection is one of the most critical decisions that will need to be made by a new owner. Among the key points to consider are:

• Regulations—A comprehensive review of the domicile’s captive regulations and any subsequent amendments should be one of the first selection steps. Important aspects include capital and surplus requirements, permitted lines of business, types of ownership structures allowed and investment restrictions.

• Taxes—Most consultants will tell you never to form a captive for tax reasons and, while that is true, it should be pointed out that taxes have a major impact of the cost effectiveness of a captive. An analysis of any premium tax amounts and whether those amounts are capped should be documented. Additionally, any excise taxes and income taxes should be noted.

• Fees and other charges—One area of difference among domiciles is how they charge captives to operate in their jurisdiction. A review of fees and other charges should be a part of any feasibility study.

• Accessibility—The physical location of the domicile is also important. How easy is it to get to, and what is the availability of transportation there? This information is important when reviewing the meeting requirements. Accommodations available to travelers should also be reviewed, as well as costs associated with them.

• Infrastructure—Since, in most instances, the captive owners will need to farm out the day-to-day operations of the captive, it is important to determine the quality of the service providers available in the domicile. Generally speaking, the more established domiciles have a better selection of qualified service providers. Newer domiciles frequently must depend on support services from remote locations.

• Miscellaneous—There are several other items that need to be reviewed prior to the domicile selection. One of these is the reputation of the domicile, but equally important is how well the captive owner gets along with the regulators. It does little good to select a respected domicile and find out that the insurance department does not support your views for captive formation. Political stability is also a consideration for captive domiciles. While this has historically been discussed with regard to offshore domiciles, with so many new onshore domiciles, it will require an assessment of how committed the domicile state is to the captive business.

While these are the majority of items that should be considered before selecting a domicile for a captive, each situation will be unique. As a result, each captive and its owners will need to determine just how well the domicile fits into the strategic plans of the captive.

Conclusion

With increased frequency, corporate insurance buyers and mid-sized business owners are seeing the advantages of captive ownership. They see the opportunities that captives can provide and have been expanding their usage in a number of different ways. But they are not the only people that see the opportunity in captive ownership. Twenty states have also seen the opportunities offered through captives and have passed appropriate captive legislation. Additionally about 40 offshore domiciles have also passed enabling legislation to take advantage of the worldwide growth in captive formations.

While it would be easy to be frustrated by the plethora of domiciles, what captive owners must realize is that they have significant choice when it comes to the location of the domicile. Due to this influx of captive domiciles, it is much easier to locate a domicile that fits your exact requirements and offers a flexible environment for your captive. The location is an important consideration, so make certain to do your homework and select a domicile that best matches your specific requirements. *