|

Marketing

Terrorism is terrorism

TRIA changes expand definition of terrorism to include homegrown variety

By Thomas H. Wetzel

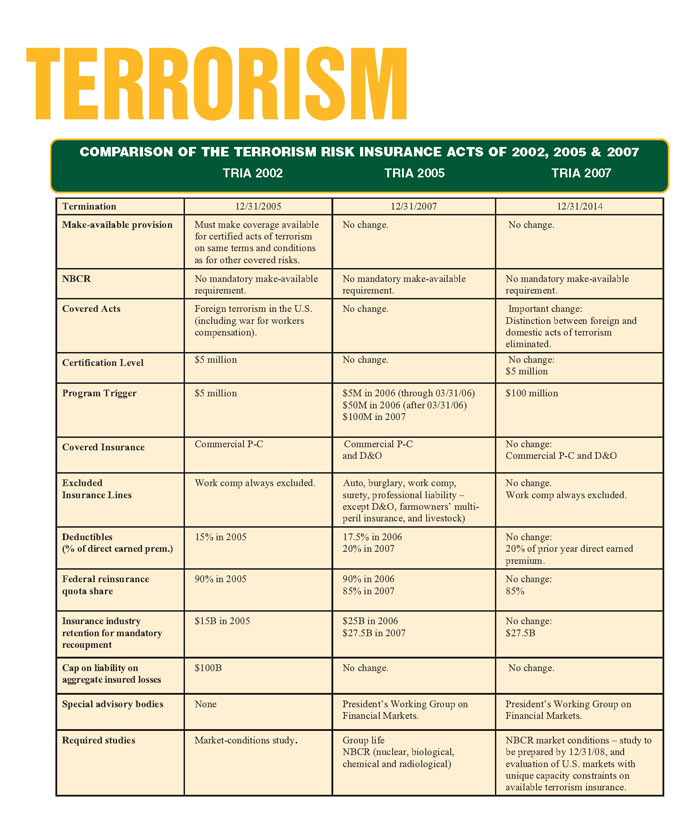

Last year, agent associations and other industry groups were pressing Congress to extend the Terrorism Risk Insurance Act (TRIA), which provides a backstop of federal insurance for the heightened terrorism risk that has existed since September 11, 2001. It has been nearly a year since the passage of the seven-year extension of the act, and agents appear to be selling no more coverage this year than last, despite the fact that the new law contains significant enhancements.

“My clients didn’t see a need before the new law, so the new doesn’t make a difference” is the consensus view expressed by many producers to whom we talked.

Elizabeth Francy Demaret, managing director of Worldwide Risk Service Group for Arthur J. Gallagher, puts it this way: “The fact that there are important changes in the TRIA extension has apparently not altered policyholders’ interest in the act or whether or not they choose to purchase coverage,” she says. “Those who were interested before remain so. Those who decided not to buy coverage are not.”

Terrorism coverage is a process of adverse selection; in other words, those who perceive greater risk are more likely to purchase coverage. Those in large cities see the risk more readily. In suburbs or smaller communities, they are less likely to see a risk that warrants coverage.

It’s one thing to think about the exposure to one’s own facilities, but what about those of vendors, suppliers, and even clients? A company, for example, that ships its products by rail may have significant exposure if the freight goes through a large urban area.

Peter Brown, senior vice president of the San Francisco-based Farallon Associates, says his brokerage “seldom” sells terrorism coverage, adding that clients don’t like the fact that it requires so many signatures.

During the debate in Congress last year, legislators and lobbyists alike battled over many changes to the act. Ultimately, the U.S. House of Representatives proposed a mandatory offering for nuclear, biological, chemical and radiological coverage (NBCR), an addition of group life and farmowners coverage, a reset mechanism to reduce insurer retentions for sites already hit with acts of terrorism, and a 15-year term.

The Bush administration, which argued against expanding the federal government’s role, threatened to veto the House version. In response, the U.S. Senate crafted a smaller bill, which was eventually agreed to by the House.

Key elements of the new act include:

• It applies to all new, renewal or quotes for insurance issued after 12/26/07.

• It removes any distinction between domestic and foreign acts of terrorism. An act of terrorism that causes a major loss no longer needs to be of a foreign nature to trigger the federal program.

• The act is extended for seven years to 12/31/14, which benefits longer-term commercial projects that need a longer period of insurance protection.

• NBCR - other versions of the proposed legislation attempted to mandate that insurers offer coverage for nuclear, biological, chemical and radiological attacks. The new act does not require coverage for nuclear, biological, chemical, and radiological (NBCR) attacks but does require the Comptroller General of the United States to conduct a study of the availability and affordability of insurance coverage for NBCR losses, a report of which must be completed by the end of 2008.

• The TRIA program trigger is set at $100 million, so federal funds will be tapped only if losses from terrorist acts are likely to exceed the $100 million threshold.

• The $100 billion cap on aggregate insured losses offers a cap on losses for insurers.

• It requires clear and conspicuous notice to policyholders of the existence of the $100 billion cap.

The biggest change in the act is that both foreign and domestic acts of terrorism are covered. It should be noted, however, that TRIA applies only to acts of terrorism in the United States. If a policyholder needs coverage outside the United States, it may be difficult to find in countries without a similar TRIA-type mechanism. Currently, countries with a terrorism risk insurance program include Australia, Austria, Belgium, France, Germany, the Netherlands, Spain, Switzerland, and the United Kingdom.

It may be tempting to become complacent now that the battle over the extension is resolved but, in fact, the real work should commence. Policyholders need to make sure that their facilities are secure, whether they have purchased terrorism coverage or not. Those companies that do not have coverage should reexamine their decision to opt out. While it is true that their workers compensation coverage covers their employees, they can no longer wait to get a better deal.

The author

Tom Wetzel is a seasoned public relations counselor and principal of Thomas H. Wetzel & Associates, Inc. He has nearly 30 years of insurance communications experience. Prior to forming his marketing communications firm, he held positions with the Michigan Association of Insurance Companies and the Insurance Information Institute.

|