|

Building agency leaders

MarshBerry's Leading Young Tigers prepare for management role

MarshBerry’s Leading Young Tigers prepare for management role

By Elisabeth Boone, CPCU

When asked what they want to be when they grow up, few youngsters say their ambition is to manage an independent insurance agency. In fact, many kids whose parents own an agency deliberately choose other career paths, although some eventually return to the family business and discover opportunities they hadn’t known existed.

Among young people whose families don’t own an agency, their paths into the business form an intriguing pattern in which chance often plays a major role. Taking an insurance elective to fill a hole in a class schedule…striking up a conversation with a stranger on a plane who happens to own an agency…having a positive encounter with a local agency during the settlement of an auto claim…these are just a few of the ways in which young people may find themselves in the independent agency business.

Whether a young person has grown up in a family agency or come into the business by some other route, a key issue facing independent agencies today is how to prepare young people to assume the responsibilities of ownership and management when the current owners retire—or when other circumstances, such as illness, injury, or death—create a gap in agency leadership. With the number of independent agencies continuing to decline and competition for desirable business intensifying, a key challenge for agency owners today is developing a comprehensive plan for agency perpetuation.

Experience can be a great teacher, but as agency operations become more complex and sophisticated, the owners and managers of tomorrow can benefit substantially from formal, structured training combined with hands-on learning opportunities.

That’s the conviction of industry veteran Larry Marsh, who founded the consulting firm Marsh, Berry & Co., Inc., and last year retired as CEO while retaining his position as vice chairman.

MarshBerry sponsors APPEX (Agency Peak Performance EXchange) to assist the owners of independent agencies in maximizing performance and profits and in dealing with the spectrum of issues that confront the independent agency system. At the APPEX Executive Symposium for Performance held in Cleveland last October, Larry Marsh told attendees at a panel discussion: “A key concern for almost three decades has been: How are agencies going to perpetuate? At the end of each decade, 50% of the agencies that existed at the beginning of the decade are gone. Time is getting short for a lot of agencies.”

That stark reality, Marsh asserted, demands a committed, focused response. To help APPEX members meet the challenge of perpetuation, Marsh spearheaded the creation of the Mentoring and Apprenticeship Program for Leading Young Tigers (MAPLYT).

At last October’s panel discussion, Marsh shared his vision for MAPLYT. “I want to recruit a dozen or so young apprentices who are absolutely driven to have a future in agency leadership,” he said. “I want to work with them for three years, then mentor them for an additional two years. My goal is to get them much better equipped to become agency CEOs, and to shorten their time between being newly qualified and fully qualified.”

Demanding program

Launched early this year under Marsh’s leadership, MAPLYT is the centerpiece of MarshBerry’s new practice, MarshBerry Educational Services. The “freshman class” consists of 13 young people who have been identified by their agency owners as future owners and managers. Beginning with an in-depth personal interview with Larry Marsh, each candidate for MAPLYT must meet strict selection criteria.

He or she must be a college graduate, less than 10 years out of college, and employed in the insurance industry for at least two years, with a minimum of one year’s experience in an agency. A candidate must be actively engaged as an insurance producer, committed to participating in a rigorous five-year program of classroom and self-study, and, in concert with the Leading Young Tigers theme, be “young, hungry, driven, committed, fearless, and willing to learn.”

MAPLYT coursework is structured so that apprentices learn agency management principles by looking through the eyes of a chief executive officer, chief operating officer, chief financial officer, sales manager, and IT manager. Formal classroom study is supplemented with opportunities for hands-on application of principles so that participants learn to use working tools to solve the problems an agency CEO routinely confronts.

A key element of the MAPLYT program is Agency Exchange Meetings, in which apprentices visit APPEX member agencies. During the first three years of the program, Larry Marsh and MarshBerry’s operational consultant, Kel Plasket, will make a two-day visit to each of the agencies that employs an apprentice. Of the four apprentices who participate in each visit, one will be employed by the agency being visited and three will be from other agencies represented in the program. During each visit, the consultants will review every aspect of the agency’s operation, then share their observations with the apprentices and the agency’s management in a formal Operational Review report. In the fourth and fifth years of the program, apprentices will conduct as many agency visits as they wish and must provide formal feedback.

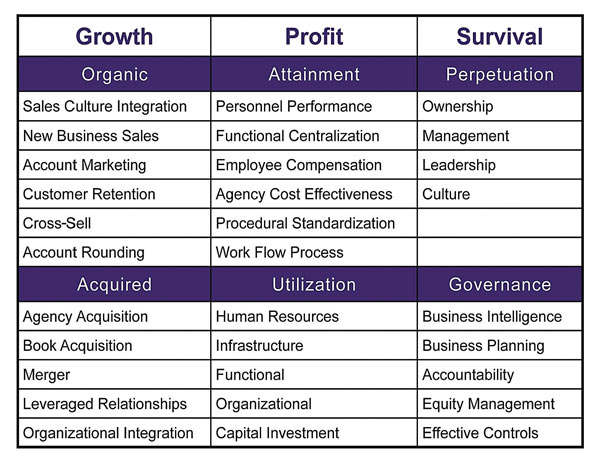

Progressing from basic to intermediate to advanced, studies revolve around a set of disciplines that focus on the achievement of three key agency objectives: growth, profit, and survival. The chart on page 78 depicts the relationships among the elements of the MAPLYT course of study.

The launch

The kickoff meeting for MAPLYT was held in Dallas in February of this year, and by all accounts the baker’s dozen apprentices got off to a great start. A second meeting was held in Chicago at the end of April, and in July the apprentices went to MarshBerry headquarters in Cleveland for their third meeting.

With MAPLYT well into its first year, Rough Notes spoke with three of the apprentices to learn about their experiences and accomplishments thus far.

Michael and David Robinson are brothers whose parents own Rogers & Gray, an agency with five locations on Cape Cod, Massachusetts. Brian Tanner is a national accounts producer in the Birmingham, Alabama, headquarters of Cobbs, Allen & Hall whom top management has identified as having strong potential to assume a leadership role in the agency. Tanner and the Robinsons speak enthusiastically about the program and clearly have established an easy camaraderie that they say is shared by all of their fellow apprentices.

Mike Robinson has an undergraduate degree in health care administration and also earned an MBA with a concentration in marketing. Despite the fact that his family owns an agency, he says, “I never thought I’d get into the business.” After working for a Boston health care system for several years, he joined Rogers & Gray in 2003. “I came in as a commercial lines producer and now have taken on more of a sales management role,” he says.

Like his brother, Dave Robinson didn’t plan to join the family agency. After graduating from the University of Colorado at Boulder, he decided to pursue a career in financial services. “After passing the Series 7 exam and other tests so I could become a licensed equities dealer,” he says, “I did a brief stint at Waddell & Reed Financial Services.

“Just as I was getting started there, about four years ago, our agency decided to expand its financial services operation,” Dave continues. “We were able to participate in a broker/dealer program that was designed specifically for insurance agencies, so the timing was right for me to join Rogers & Gray. I currently manage production in financial services as well as employee benefits, and I also manage our personal lines operation.”

When their father retires, Dave and Mike will share agency management responsibilities with a third partner, Bob Bizak, a non-family member who runs the commercial lines operation.

Brian Tanner is a 1998 graduate of the University of Alabama with a bachelor’s degree in health care management. He began his insurance career in 1999 with Arthur J. Gallagher & Company in Nashville, Tennessee, and joined Cobbs, Allen & Hall three years ago. Today Tanner is a producer in the agency’s national accounts division.

Eager to learn

Why did these three young producers decide to apply for apprentice slots in the MAPLYT program?

“The reason we did it is to get more exposure to the management of an agency and learn more about things you can’t usually learn at a young age, such as acquisitions,” Dave Robinson responds. “We also wanted to learn more about overall agency operations—sales, best practices—and we wanted to get to know the industry from a different point of view than we could do otherwise on a day-to-day basis.

Another thing,” Dave adds, “is that Larry Marsh has a great reputation, and we wanted to learn from him. Something else we saw as valuable was the opportunity to visit the other agencies that have apprentices in the program. It’s great to see first-class operations like Cobbs, Allen & Hall up close, and that’s something we couldn’t learn in our own agency.”

When Cobbs, Allen & Hall CEO Bruce Denson, Sr., approached him about participating in MAPLYT, Brian Tanner says, he was eager to sign up. “Right now I work strictly in production, with the hope of moving into some sort of management position in the future,” he says.

“This program offers the opportunity to learn about the management of an agency by being thrown into actual situations. I understand the insurance side pretty well, but I haven’t had the same exposure to the business side,” Tanner explains. “Bruce told me that if I joined the program, I’d have the opportunity to ask him a lot of questions and get more involved with Cobbs, Allen & Hall’s operations.”

Larry Marsh clearly is pleased with the makeup of his freshman class. “They’re eager and intelligent, and we’re off to a great start,” he says enthusiastically.

Gaining new knowledge

That enthusiasm is echoed by the three apprentices. In the eight months since the launch of MAPLYT, Tanner and the Robinsons say they’re learning by leaps and bounds.

“I’ve learned a lot, and it’s hard to narrow it down to just a few things,” Tanner says. A highlight of the program for him, he says, is gaining understanding of “the concept of how to value an agency, and also how to determine whether the agency you work for is doing the right things to grow value for the agency.

“Also, I’ve learned a lot about profitability from the different agency partners that are involved in the MAPLYT program. Being able to lay the financials and the PHP (Perspectives for High Performance Benchmarking) report side by side and learn from each agency’s successes and failures, and having the opportunity to ask them a lot of what can be tough questions, gives us a true perspective on how different agencies are run,” Tanner continues.

“We’re all pursuing the same objectives, but each agency does things differently, and being in the program gives us good ideas for how we might be able to improve our own agencies,” he concludes.

The Robinson brothers also are finding significant value in the MAPLYT program. “The biggest thing we’ve taken away from the program is learning the actual mechanics of acquisition,” Dave says. “Our agency was in the process of looking at an acquisition, and both Mike and I got very involved in that process. We were able to use what we learned from Larry to offer better input into the acquisition decision.”

What’s more, Dave continues, “We’ve learned a lot about the financial mechanics of an agency, and how the key ratios we use can affect the agency’s financial picture.”

For a young producer, the retirement of the current agency owner may seem to be a long way into the future, and sometimes it is. Sometimes, however, fate takes a hand, and someone who thought he or she would have another 20 years to prepare for ownership and management may suddenly be handed the reins and expected to take on a mountain of responsibility.

Whatever the future may hold for Larry Marsh’s young MAPLYT apprentices, it’s clear that they’ll have both the theoretical and practical knowledge they’ll need to take on the myriad challenges of agency management.

For more information:

Marsh, Berry & Co.

MAPLYT

Contact: Doug Terrill, SVP-Educational Services or

Brian Witherspoon, Executive Director, APPEX

Phone: (440) 354-3230

Web site: www.marshberry.com/partner

exchange |