|

Workers comp—Another good year?

NCCI is cautiously optimistic about continued good results

By Dennis H. Pillsbury

The Annual Issues Symposium presented by the National Council on Compensation Insurance (NCCI) has consistently been one of the best meetings in the industry. The day-and-a-half meeting features excellent speakers offering a plethora of thoughtful information. And it may be the only meeting where the actuary’s report is given to a rapt, standing-room-only crowd.

Thus, it was only mildly surprising to learn that the attendance at this year’s meeting, held in May in Orlando, was down only 2% from last year’s record attendance—quite a feat in a year that has seen double-digit attendance drops at most meetings.

In his “2009 State of the Line” report, NCCI Chief Actuary Dennis C. Mealy, FCAS, MAAA, said, “The property/casualty insurance industry came through the financial turmoil of the last year in remarkably good shape.” Despite a 12% decline in surplus to $462 billion in 2008, the industry “remains strongly capitalized for these uncertain times,” Mealy added (Chart 1).

“The workers compensation part of that industry also had a good year. All the major financial performance measures for the workers compensation insurance industry continued to perform well in 2008,” he continued. “The calendar year and accident year underwriting results continued near breakeven (Chart 2), which in this investment climate is a necessity for the industry to hope to earn a reasonable return on its capital.”

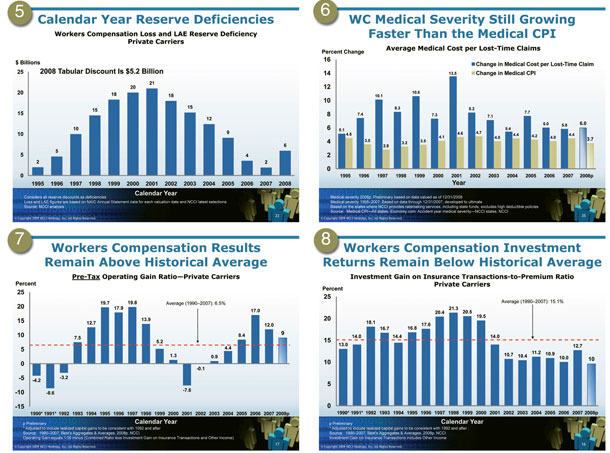

In addition to a strong capital position, Mealy also pointed to other positive factors, including a continued decline in frequency (Chart 3), depopulation of residual markets (Chart 4), and a reserve position that is “reasonably adequate” (Chart 5).

However, he also noted that there are a number of challenges facing the industry, many of which are unchanged from previous years, that explained why “NCCI’s short-term view of the industry is now guarded and the long-term outlook is cautionary.”

The perennial problem, which remains “the single biggest cost challenge the industry faces,” is medical cost inflation. Mealy pointed out that although the growth in medical costs has ameliorated, “they are still increasing at least twice the rate of general price inflation” (Chart 6). The continued high inflation rate in medical costs has resulted in a change in workers comp from an indemnity-focused coverage to a medical cost-focused coverage. In 1988, indemnity losses equaled 54% of total losses, with medical at 46%. In 2008, medical losses accounted for 58% of losses, with indemnity at 42%, according to preliminary estimates from NCCI.

A second troubling factor that has been exacerbated recently is low investment yields, “along with the potential of a stagnant stock market.” Mealy pointed out that, “With the interest rates on fixed-rate home mortgages at all-time lows, the yield on 10-year treasuries less than 3%, and the meltdown of the financial markets, we cannot expect much relief anytime soon.”

Despite an abysmal stock market performance in 2008, the workers comp results remained above historical averages at a pre-tax operating gain of 9% (Chart 7). This was thanks to a strong underwriting performance that resulted in a combined ratio of 101 coupled with a conservative investment portfolio that returned 10% on insurance transactions (Chart 8).

Mealy also expressed concern about the uncertainty of the underwriting cycle. “The pattern of combined ratios from 2004-2008 is looking eerily similar to the pattern from 1993-1997, at the low point of the last cycle. Hopefully, the industry is not repeating past cycles of deteriorating underwriting results. The 2008 accident year combined ratio is 100%, up 4 points from a revised 2007. The current underwriting cycle topped out in 2006, with an 85% combined ratio, more than a 58-point improvement since 1999.”

Also causing concern is the fact that the good results experienced by the industry may cause some legislators “to review benefit levels and past reforms, to the potential detriment of efficiently running and well-balanced workers compensation systems.”

The final factor causing uncertainty is the changed political landscape in Washington. “The nation has a Democratic president with large Democratic majorities in both house of Congress for the first time since 1993. The new administration has health care and revised federal regulation of the financial services industry as two major items on its agenda. Although it is too early to say what might happen, changes in either of these areas could have major implications on how the workers compensation insurance business operates.”

|