|

It could happen here!

The possibility of an earthquake looms large while coverage lags

By Phil Zinkewicz

Months now have passed since that devastating January 12 when, at the point of the Enriquillo-Plantain fault system in Haiti, a 7.3 magnitude earthquake struck, 16 miles west of the capital of Port-au-Prince. This disaster was followed by the 8.8 magnitude quake in Chile on February 27.

In Haiti, all hospitals in the inner city area, plus air, sea and transport facilities and communications were severely damaged or destroyed. Buildings in the finance ministry, the ministry of public works, the ministry of communication and culture, the Palace of Justice, the Superior Normal School, the National School of Administration, the Institut Aimé Césaire, Parliament, National Palace, World Bank and Port-au-Prince Cathedral collapsed. In addition, inmates fled the Prison Civile de Port-au-Prince after it was destroyed. And those were only the initial developments.

By the second day, few houses were left, causing people to sleep in streets. Countless family members were either missing or dead. After the morgues filled up, survivors had no other choice but to dump bodies into the streets. Those trucks that survived the quake were used for the grisly task of doing the dumping. A few days later, hospitals around the border were filled to capacity with Haitians requiring medical treatment, medicine and all other essential resources. By the 17th of January, shortages of food and water began turning people violent, and looting became prevalent.

Because of airport congestion, relief agencies and the U.S. Air Force had to begin air drops of needed supplies in the countryside. Homeless people had been relocated into makeshift camps there.

All natural disasters are dreadful, most of all because of the loss of lives. But earthquakes bring with them special horrors that it’s impossible to prepare for—the unexpected ground shaking signaling the onset of the quake, buildings tumbling over panicking people, and raging fires that erupt afterwards. In some of the eyewitness reports following the well-documented and well-storied San Francisco earthquake of 1906, stories abounded of police having to shoot people who were trapped in burning rubble to prevent them from suffering horrific deaths.

The damage and destruction of property from an earthquake can be worse than other forms of natural catastrophe. Usually, when damage to property occurs, people look to insurance to make them whole. However, for one reason or another, sometimes that insurance is not always there.

Haiti’s private insurance market is very small, although its government did provide a level of insurance coverage to its citizens by being a member of the Caribbean Catastrophe Risk Insurance Facility (CCRIF), according to the New York-based Insurance Information Institute (I.I.I.).

“Haiti is the poorest country in the Western Hemisphere, and poor countries tend to purchase very little insurance coverage,” says Dr. Robert P. Hartwig, CPCU, president and economist for the I.I.I. “The fact that there is very little information about Haiti’s private insurance market suggests that the market is very small—likely not more than a few tens of millions of dollars.”

On the other hand, although the United States is not a small country, and earthquake insurance is available, too few people are buying it. Hartwig says that the situation in Haiti should serve as a reminder of U.S. vulnerability to earthquakes. The potential cost of U.S. earthquakes has been growing because of increasing urban development in seismically active areas and the vulnerability of older buildings, which may or may not have been built or upgraded to current building codes, he says. Compounding the problem, he adds, is the fact that the vast majority of home owners living in seismic zones do not purchase earthquake insurance.

“In fact, only 12% of California home owners have earthquake coverage,” says Hartwig. “The severity of last week’s Haitian earthquake has been compared to that of the quake that struck Haiti in 1842, killing thousands, but few realize that the United States was also rocked by a major quake in the 19th century.

“The New Madrid earthquake of December 1811, one of the largest in U.S. history, had its epicenter in Missouri and ended up ringing church bells in Boston, more than 1,000 miles away,” Hartwig continues. “The New Madrid fault zone lies within the central Mississippi valley, extending from northeastern Arkansas through southeastern Missouri, western Tennessee, Kentucky and southern Illinois.

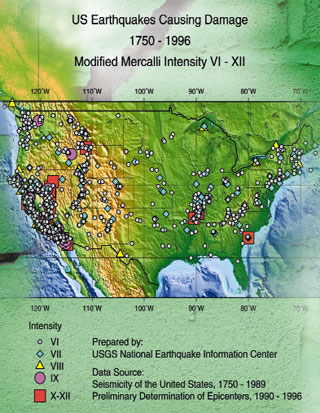

The I.I.I. reports that since 1900, earthquakes have occurred in 39 states across the country. Minor earthquakes, for instance, struck states such as Illinois and Nevada in 2008. However, there has not been a major quake on the U.S. mainland since the 6.7 magnitude, Northridge, California, event in 1994.

California remains the state most at risk of a major earthquake. A huge one is more likely to occur in southern California than in northern California sometime during the next 30 years, according to a 2008 study compiled by experts from the U.S. Geological Survey, USC’s Southern California Earthquake Center. The 1994 Northridge earthquake and the 1989 6.9 magnitude Loma Prieta earthquake that struck the Oakland-San Francisco area during the World Series were the two most costly earthquakes in U.S. history as defined by insured losses. In 2008 dollars, Northridge caused an estimated $19 billion to $29 billion in insured losses, while the Oakland-San Francisco quake resulted in insured losses totaling a little over $12 billion.

“Yet, almost 16 years after 1994’s Northridge, California, earthquake, only about one in eight California residents have their homes or businesses insured for property loss in the event of a quake,” according to the Insurance Information Network of California (IINC).

Sydney Croxdale, owner of the Missouri-based Bohrer-Croxdale & McAdoo, Inc., a managing general agency that writes primarily in Missouri, Kansas and Arkansas for approximately 900 retail agencies, says that her agency quotes “a lot of earthquake” risks, but that “we sell very little.”

Says Croxdale: “There is no lack of capacity for earthquake insurance in the business, but there is a resistance on the part of home owners to buy it. Many people just don’t believe that they will be victims of earthquakes or they don’t want to spend the money.”

She says that the cost of earthquake coverage varies, depending on where the home or business is located. “Rates are higher, for example, on the east side of Missouri, but lower on the west side.”

Other factors that determine earthquake insurance rates are the location of the building and the materials used in its construction.

Most people know that earthquakes are not covered under standard U.S. homeowners or business policies, but the coverage is available in the form of supplemental coverages to home owners or businesses. Earthquake insurance policies often carry a deductible, generally in the form of a percentage, rather than a dollar amount. Deductibles can range anywhere from 2% to 20% of the structure’s replacement value. In California, home owners can also secure coverage from the California Earthquake Authority (CEA), a privately funded, publicly managed organization.

“There are people who live with earthquake exposures every day but still do not buy the coverage,” says Croxdale. “In part, it’s a matter of ‘out of sight, out of mind.’ Some time ago, we had an earthquake on the east side of Missouri and, following that, the sales of earthquake insurance rose significantly only to decrease rapidly after a year at renewal time. Insurance companies and agents must educate the public on the need for the coverage.”

|

|

| |

|

| |

Since 1900, earthquakes have occurred in 39 states across the country. |

|