|

Agency Financial Management

The agency price in your future

Whether an ownership transfer is imminent or not, keep valuation in your sights

By Lorna L. Gunnersen, CPA, CVA, CPCU, CIC, CRM

On January 1, 2011, the Jobs and Growth Tax Relief Reconciliation Act of 2003—also referred to as the Bush tax cuts—is set to expire. Thus, unless you are already down the road in the process of selling your agency, it is likely that you will be ringing in the New Year along with a 33% increase in the capital gains tax rate.

While much uncertainty remains about the future of the rates, the current federal capital gains tax rate of 15%, the lowest rate in 70 years, is set to expire and revert back to the 2002 rate of 20%. While a vote from Congress could extend the current rate, as of date of publication, no vote has been scheduled on the matter.

Assuming no extension, what impact does this have on the value of your agency? On an after-tax basis, this change will have a significant impact on the amount that you will put in your wallet upon consummation of a sale.

If you are currently in the throes of a transaction, your goal should be to get as much of the transaction paid at close (received in calendar 2010) as possible. Amounts taxed are based upon the timing of actual cash receipts and not the effective date of the contract; thus, any amounts received in 2011 and thereafter would be subject to the capital gains tax rate in effect for that year.

Since 2008, as an agency owner, you have had to struggle through a soft insurance market, the meltdown of the financial markets, and an economic downturn. You may be one of the many agency owners who is, or should be considering a sale, but are purposely sitting on the sidelines. Perhaps you: 1) are waiting for a hard market, 2) believe that your agency is able to grow organically and sell for more money in the future, 3) think that multiples being paid are lower than they have been historically, or 4) believe that taxes are just a fact of life and would rather bury your head in the sand when it comes to the impact they may have on a sale.

If you are waiting for a hard market or believe that revenues may be grown organically, you are not unlike other insurance agency owners. However, according to our estimates, you would have to grow your agency bottom line at least 12% annually in order to break even on the after-tax proceeds of a sale (this assumes a current federal and state tax rate of 15% and 5%, respectively, being increased to 20% and 8%).

Thus, based upon the looming increase in capital gains tax rates, what are a few strategies that you may choose to implement in order to improve your value?

Change organization structure—One of the first questions we ask agency owners who are selling is, "How is your company organized?" This has huge tax implications.

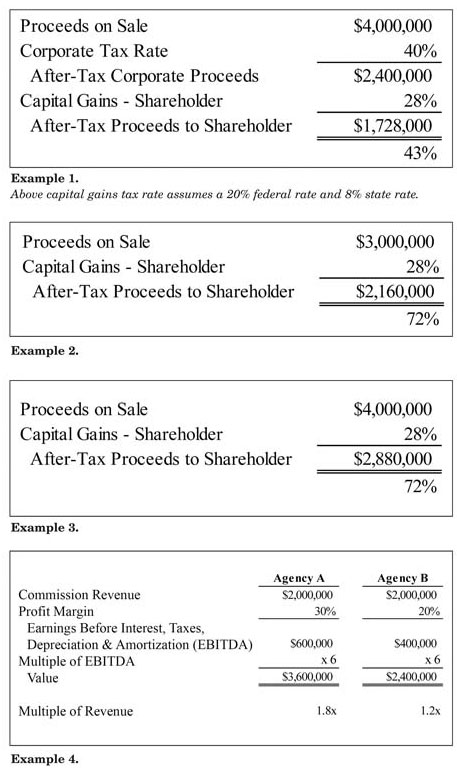

If the agency is organized as C-Corporation, a sale of the assets of the agency will result in double taxation of the proceeds. First, the proceeds are taxed at the C-Corporation level. Second, distributions of the proceeds to the owners are then taxed at the capital gains tax rates at the individual level. Example 1 reflects the overall impact of double taxation on the purchase of assets of a C-Corporation.

Bottom line, for every $1.00 of proceeds received, a total of $0.43 is netted by the owner on an after-tax cash basis.

The same company may choose to sell the stock of the C-Corporation. In return for the sale of the stock, the buyer will likely discount the value of the transaction based upon the foregone tax benefit received via tax amortization in an asset transaction. For illustration purposes, example 2 shows the same C-Corporation, with proceeds on sale discounted by 25% to reflect a stock purchase. Although the proceeds are decreased, the overall after-tax proceeds to the shareholder increase by $432,000 over the above asset purchase.

Alternatively, if the same company is an S-Corporation, limited liability company (LLC), or sole proprietorship, it will receive capital gains tax treatment in a sale of the assets of the company. This is the optimal transaction structure for both buyer and seller. The seller will sell the assets of the agency and receive favorable capital gains tax rates. The buyer is able to purchase the assets, without exposure to any undisclosed liabilities, and is able to amortize the purchase over a 15-year period for tax purposes. On a net present value basis, and at current tax and interest rates, this results in approximately 25% of the purchase price returned to the buyer over a 15-year time frame. (See Example 3.)

The above scenario results in $0.72 of every $1.00 in sale proceeds to the shareholder. Clearly, the sale of assets of an S-Corporation (LLC or sole proprietorship) produces the best alternative, with after-tax purchase proceeds at an amazing 67% more than the sale of the C-Corporation's assets.

A little planning helps to overcome the tax impacts of a C-Corporation as an owner may file an election to convert to an S-Corporation or LLC. However, in most instances, a 10-year period must pass in order to receive the full benefit of the conversion.

Monitor financial results—The majority of business owners understand the relationship between profitability and valuation. It just makes sense that a buyer would be willing to pay more for an agency that is more profitable. Consider the following illustration of $2 million revenue-generating agencies. Agency A and Agency B generate a 30% and 20% pre-tax profit margin, respectively. Given that all other risk factors remain equal, Agency A would command a $1.2 million premium over Agency B. That, in itself, should provide ample motivation to monitor financial results closely. (Example 4.)

In a soft market and down economy, it is critical to closely monitor financial results and hold down expenses. As revenues decline as a result of decreased workforce, bankruptcies, and a soft marketplace, expenses are often slower to decline and may even increase. These thinning margins result in lower valuations by potential buyers.

The two largest expense line items on financial statements are personnel costs and facility costs; thus, owners need to monitor compensation as a percentage of revenue and make any necessary changes in producer commission schedules, staff compensation and overall staffing levels. Consider negotiating commercial lease agreements as many lessors would rather keep a paying tenant than have an empty facility.

Long-term planning—In general, make sure that risk characteristics of an agency are low. Make sure that the agency is well diversified in terms of accounts spread among producers, that no significant accounts would cripple the agency if lost, and that there is no dependence on any one carrier. It is advantageous to have revenues spread among commercial, personal and group benefit accounts as now, more than ever, this diversification into other lines of business and rounding of accounts has helped many agencies retain clients and maintain profitability.

Another positive factor is having a workforce with a good age spread: for instance, tenured producers in their 50s and 60s along with others coming through the ranks in their 20s, 30s and 40s. Having younger producers not only assists with internal perpetuation, should that be the long-term goal, but it is seen as a value-adding characteristic to an external buyer.

Agency owners should focus on automation to make their firms more efficient. Monitor financial ratios and efficiency results (i.e., revenue per employee results), and make an effort to achieve top standings in your peer group.

Above all, maintain an "in trust" result on your financial statements. Thus, cash plus trade receivables should be greater than carrier payables. If this is not the case, it is likely that the agency is violating state law, violating carrier contracts and, plain and simple, employing unethical business practices by utilizing policyholder funds to pay current operating expenses.

Regardless of where your agency may be in its business life cycle, the above suggestions will help you prepare for internal or external succession whether it is sooner or later.

The author

Lorna L. Gunnersen is a director and co-founder of Mystic Capital Advisors Group, LLC. She can be reached at (303) 618-8238 or at llp@mysticcapital.com. For more information on Mystic Capital, visit their Web site at www.mysticcapital.com. |