|

Keeping it simple

Liberty Mutual offers agents single-point access to distribution and service for commercial accounts

By Elisabeth Boone, CPCU

Less than 10 years ago, the Liberty Mutual Group was best known as a workers

compensation carrier that used multiple channels to distribute its products.

Solid, reliable, and traditional, the company was notable more for its

consistency than for bold, game-changing initiatives.

The Liberty Mutual of today enjoys a well-earned reputation for engineering

disciplined yet dramatic changes in its structure and operations to create an

energetic, efficient, and unmistakably agent-centric organization.

Since completing a series of major acquisitions (Wausau, Ohio Casualty, and

Safeco) and eliminating its direct distribution channel, Liberty Mutual has

marshaled substantial resources to establish itself as a market of choice for

agents and brokers who serve middle market to large commercial clients.

In an exclusive interview with Rough Notes, Mark Butler, president of distribution and service management in Liberty Mutual’s Commercial Markets strategic business unit, offered key details of the unit’s new distribution and service management model. In essence, he says, the unit

has been reorganized to give agents and brokers a single point of contact for

accessing commercial property, casualty, and specialty lines for their national

accounts and mid-sized clients. The new model also provides access to claims

and loss control services.

The reorganization, Butler explains, “is not just about distribution and service management, but about our entire

Commercial Markets operation.” Previously, he says, the operation was made up of various business units:

National Markets, Middle Market, Property, and Specialty Lines.

“The driver behind our decision to reorganize Commercial Markets was the lack of

a common approach to our agents and brokers,” Butler says. “It was not unusual to have representatives from each business unit calling on

agents. As we looked at the whole picture and tried to identify the needs of

our trading partners, we recognized the need to simplify our operation. We’ve created a common business unit called Commercial Markets that brings all of

those segments together under one management team,” Butler explains.

“In making this change, we have retained the identity and focus of each of our

Commercial Markets segments,” he continues. “The aim of the reorganization is to give agents and brokers easier access to our

products and services across the spectrum of our commercial operation.”

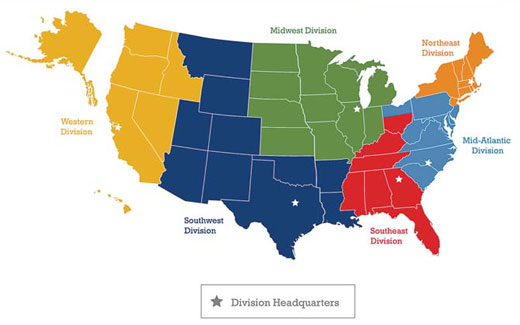

To facilitate that access, Liberty Mutual’s new distribution and service management model is operating through six new

geographic divisions and a major accounts division (see graphic on page 125).

Major accounts are those whose total cost of risk is $20 million or more.

“Our territory managers represent all of our products and services, giving our

agent and broker partners a single point of contact,” Butler says. “The reorganization allows us to offer a better coordinated approach to

delivering the full breadth of our offerings in a way that responds to our

agents’ needs at the local and regional level.”

In the process of streamlining and simplifying agents’ access to Commercial Markets, Butler emphasizes, “We made a concerted effort not to disrupt current relationships, so our

day-to-day contacts for underwriting, loss control, claims, and statistical

reporting all remain untouched. Basically, we’ve broken down the barriers between the various segments of Commercial Markets

to enhance our ability to deliver products and services to our agents and

brokers in a much more responsive fashion,” he declares.

How are agents responding to the reorganization? “It is truly resonating with our trading partners,” Butler asserts. “They have enthusiastically embraced this new structure. We announced the

reorganization on July 14, and we conducted an outreach session with all of our

appointed agents and brokers to explain that our purpose is to make it easier

for them to do business with us and to improve our responsiveness to them.”

Liberty Mutual Commercial Markets currently has relationships with some 5,000

agencies and brokerages throughout the country. Asked if he has plans to expand

the agency force, Butler replies, “We don’t have an open brokerage model; we know that there are agents and brokers who

believe in our value proposition and have the kind of business that we are

interested in, and those are the ones we try to identify and connect with so we

can complement each other’s efforts in their local territories.”

In an article that appeared in the September 2009 issue of Rough Notes (“Liberty Mutual: Marketing to the Middle”), Butler was quoted as saying: “We need a very competitive multi-line product strategy that will let us be an

all-lines provider to middle market accounts.”

We asked Butler to explain how that strategy is being implemented in terms of

new products for this important market segment.

“We’re very proud of our accomplishments in that area within a short period of time,” he responds. “In October of 2009, we introduced a multi-line product for middle market risks

called Package Solution™. It’s a highly competitive product that provides broad coverage, and it’s proving to be very popular with our agents and brokers,” Butler says.

The product combines a proprietary commercial property coverage form with

general liability, inland marine, and/or crime coverage. It can be customized

to meet the needs of 10 vertical industries: contractors; manufacturers;

wholesalers and distri-butors; retailers; food processors; restaurant owners

and operators; real estate and commercial property managers; professional

service providers; janitorial service providers, and hospitality businesses.

Pointing to additional evidence of Liberty Mutual’s commitment to the middle market segment, Butler says, “Over the past couple of years, we have devoted significant resources to

educating our agents and brokers about the experience and the product and

service offerings we bring to the middle market for general liability,

property, and auto. Previously there had been a misperception that we were only

interested in workers comp, but by partnering with agents and engaging in joint

business planning, we’ve been able to make substantial progress in the other commercial lines. From an

overall Commercial Markets standpoint, we also have expanded significantly in

the inland marine area,” he asserts.

“Over the last 10 to 15 years, Liberty Mutual has diversified significantly

across the entire organization,” Butler says. “We are a global player, and workers compensation represents only 14% of Liberty

Mutual’s total premium writings. So when you look at us in total, you can see that we

are highly diversified both geographically and in terms of product lines.”

In a market that has been soft for five years and is showing few signs of

hardening, how does Butler believe that the newly reorganized Commercial

Markets business unit can give his company a competitive advantage?

“Liberty Mutual has a strong reputation for competing on value and service,” Butler responds. “We believe that our expertise helps our insureds reduce their total cost of

risk, whether it be mitigating current losses or educating them about potential

sources of loss to minimize their exposure. From that standpoint, we look to

partner with agents, brokers, and customers who believe that insurance is not a

price play; it’s the total cost of risk. That philosophy is what has allowed us to remain

competitive in a prolonged soft market,” Butler asserts.

“We have a deep understanding of lines of business, and we’re able to respond with appropriate solutions, whether it be coverage

enhancements, filling coverage gaps, or risk management and loss control for

our insureds, or helping the agent educate the client and deliver a full

complement of products,” Butler says.

“Going forward, we have a lot more flexibility with our new Commercial Markets

structure than we did before the reorganization,” he continues. “We know that growth for growth’s sake is not a good strategy; we have to identify those market segments in

which we can still be profitable. Our overall strategy will remain the pursuit

of prudent growth by segment.”

As the nation’s fifth largest property/casualty insurer in terms of direct written premium,

and as a global entity with operations in 17 countries, Liberty Mutual is of

necessity a very large organization; it employs more than 45,000 people in more

than 900 offices around the world. Within each of its strategic business units,

however, the company is solidly committed to being flexible and responsive to

agents and insureds at a local level.

For more information:

Liberty Mutual Group

Web site: www.libertymutual.com

|