|

|

|

More than $11 trillion at risk A cyber-attack could endanger the revenue stream of virtually any business

As computers have taken over many of the traditional functions once handled by human beings and "plastic" has replaced cash for most transactions, the information developed by the combination of these two trends has become almost invaluable to the scrupulous, the unscrupulous and those who are somewhere in between. Marketers are using the information to target individuals who are likely to buy their product, while identity thieves are attempting to find ways to obtain information that will allow them to live in style at someone else's expense. And those of us who have suffered through the recent election cycle, especially those individuals in what were dubbed swing states, know very well how this type of information was used to target them for robocalls and seemingly interminable political advertising. While much of the above represents annoyances that most of us have learned to tolerate, this is not true when outright larceny is involved. And even the threat that such larceny may have occurred can result in millions of dollars in losses as companies that may have had a data breach are required to notify all individuals whose information might have been compromised.

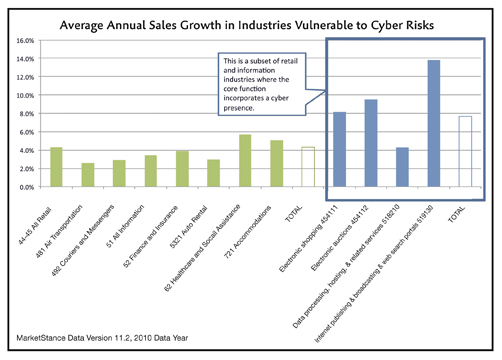

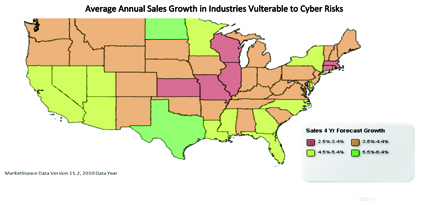

At the top of the list of industries that have already been impacted by these requirements are those that are intimately involved in cyberspace—those companies that operate strictly online or are involved in some way in assuring the safety of transactions on the Internet. However, as we have seen time and again, industries that gather sensitive information, like health care, also are targets for cyber-attacks and there have already been instances where health care entities have spent millions of dollars notifying patients that their records might have been placed at risk. In essence, with very few exceptions, nearly every business is at risk and needs some form of cyber liability coverage. MarketStance, Middlebury, Connecticut, compiled data on those industries it views as most susceptible to some type of cyber loss and determined that more than 6.6 million businesses representing nearly $11.8 trillion in sales could be targeted by some type of cyber threat. And, while most attacks are thwarted, the enormity of the potential target and the potential ill-gotten gains that could be realized by one successful attack, make it clear that attempts will continue and some successes will be the result. The MarketStance data also indicate that those industries that are almost completely dependent on cyberspace are among the fastest growing in the United States, with expected annual sales growth of about 7.7% over the next four years, compared with 4.3% annual sales growth for all industries. And there already are a significant number of businesses operating in the cyber world (more than 141,000 businesses producing nearly $207 billion in sales.) Electronic shopping represents the largest subgroup in this category, with some 64,000 businesses generating $110.9 billion in sales, and this is expected to grow at an annual rate of 8.1%. The 51,000 businesses engaged in data processing, hosting and related services produce some $54.7 billion in sales. However, this segment is expected to grow only 4.3% annually. The more than 24,000 businesses engaged in electronic publishing and broadcasting and Web search portals produce some $28.1 billion in sales and are expected to show the strongest annual sales growth of 13.8% over the next four years. The more than 2,000 companies engaged in electronic auctions represent some $13.0 billion in sales and are expected to enjoy an annual growth rate of 9.5%. Of course, this is just the tip of the iceberg. For those individuals with atrabilious proclivities who see the Information Age as a harbinger of Armageddon, there certainly are plenty of frightening statistics to back that up. Consider the fact that retailers in general have compiled sensitive consumer databases that undoubtedly are targets for the unscrupulous. And that represents more than 2.4 million businesses with $4.2 trillion in sales. Want more to worry about? How about the airlines? Think about the information you share with them when you make online reservations. And, of course, for you Willy Sutton fans, there are the banks and other institutions that collect a tremendous amount of personal information to use as identifiers to make sure your accounts are secure. And many modern-day Willy Suttons are naturally targeting those institutions because "that's where the money is." And let's not forget about the health care industry, perhaps the largest collector of sensitive information. And it too has been the target of numerous cyber-attacks. Equally troubling is the fact that, according to a recent Towers Watson & Co. study, about three-quarters of American businesses have no cyber liability coverage of any type, believing that their systems are secure or that they simply aren't a target. For those individuals with a more sanguine outlook, and that would include most independent insurance agents, this simply means there is an enormous market out there waiting to be convinced to purchase cyber liability coverage. Assuming the Towers Watson estimate is correct, then there are some five million businesses to target. That's certainly nothing to sneeze at. For additional information go to www.marketstance.com. Questions can be e-mailed to ms@marketstance.com or call (888) 777-2587.

|

|||||

| |||||

| ©The Rough Notes Company. No part of this publication may be reproduced, translated, stored in a database or retrieval system, or transmitted in any form by electronic, mechanical, photocopying, recording, or by other means, except as expressly permitted by the publisher. For permission contact Samuel W. Berman. |