|

Building Equity Value

Fight to preserve value—or sell

Shrinking profit margins add urgency to agencies’ need to generate growth

By John J. Wepler and Patrick T. Linnert

(Editor’s note: This month’s “Building Equity Value” column is a condensed version of a white paper prepared for MarshBerry clients.)

Within the next three years, the past cycle of real and anecdotal claims of 8.0 to 9.0 times EBITDA deal pricing will be revered as the good old days for many agencies (EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortization). Last year’s short era of 10.0 to 14.0 times EBITDA achieved in a handful of billion-dollar private equity transactions will become legendary. Only the minority that have systematically reinvested to build a sales culture and a productive operating model will be able to sustain premium value in the coming cycle. For those lacking executable plans to achieve growth in revenue and profitability, agency value will spiral downward.

Organic growth for independent insurance agencies averaged 4% in 2007. However, profitability did not grow because inflationary and discretionary expense increases kept pace with revenue growth. And public brokers performed even worse than the average agency in 2007—the public brokers achieved an average organic growth of only .6%. As a result, the public brokers’ per-share price and market capitalization took a monumental hit. Agency owners who remain independent will feel the same pain unless they have a plan to drive profitable growth.

Premium rate environment

The current soft market in P&C has stifled revenue and profit growth, and rate relief remains elusive. To diversify from their dependence on P&C and for many other reasons, insurance agencies around the country broadened their product mix over the past decade by building the health side of the business. Health insurance totals 15% of commission income in the average agency and as much as 35% of commission income in high-performing shops. Those who focused on building their health insurance book made a good bet. Health insurance produces stronger profit margins, helps solidify P&C accounts and has experienced a very favorable rate environment.

Unfortunately, commission income in the health area is now under fire. Premiums related to employer-sponsored health insurance are facing sustained softening. The rate of growth in overall health insurance premium has been falling for the past five years, given fewer employers offering insurance and an increase in risk-sharing going back to covered employees through increased co-pay arrangements and higher deductibles. And this trend has only begun: Gross health insurance premium within the distribution system will continue to soften as more expenses are shifted to the insured and fewer claims at the low level are retained by the underwriters.

Most P&C companies are aggressively pursuing rate reductions in an attempt to grow market share. Without a marked and prolonged deterioration in the investment market or interest rates, the P&C sector will not experience substantive rate relief in the next couple of years. While the bottom of the rate trough may occur as early as 2010, we do not expect to see any meaningful rate increases on the horizon.

Despite strong P&C carrier financials during 2006 and 2007, continued softening is projected to deteriorate carrier return on equity metrics during the next couple of years. In response, many carriers are seeking to improve their operating expenses and loss ratios by working with fewer agencies that can meet higher premium volume requirements and that have an organic growth plan, risk mitigation consulting capabilities and diligent field underwriting.

Premium agency valuations

Agency value reached an all-time high during 2007. The overwhelming demand for insurance agency acquisitions drove average deal pricing to more than 7.0 times pro forma EBITDA and over 1.75 times pro forma revenue, including the portion allocated to earn out. High-performing agencies secured pricing as high as 10.0 times retrospective EBITDA, including expected earn-out proceeds.

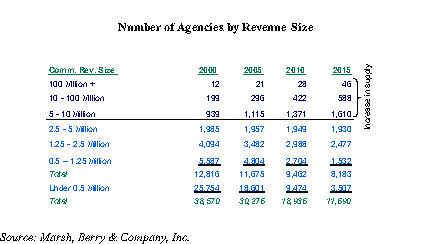

During the past five years, almost every agency was marketable, regardless of quality, but times are changing. Buyers are rapidly becoming more selective. Higher valuations are increasingly being reserved for quality agencies that can help buyers trade up on their own weakening performance. It is also becoming more common for buyers to place a higher value on those that can either fold into an existing location or serve as a stand-alone branch location. Buyers are also becoming more selective about what qualifies as a stand-alone branch location. We predict that within the next three years this bar will reach as high as $5 million in revenue, coupled with the ability to generate minimum organic growth of 5% and minimum EBITDA of 22%.

At the core of agency value is the ability to demonstrate sustainable predictable earnings growth. With substantial softening and natural attrition, new business production simply is not sufficient for most agencies to grow organically. To compound the problem, deteriorating premium growth has increased loss ratios within the average agency, hitting contingent and supplemental income.

Given that every agency has fixed expenses, revenue deterioration has been accompanied by a decline in EBITDA as a percentage of revenue—or, as they say on Wall Street, “margin compression.” Lower profitability simply means lower value. No matter how you slice it, margins are coming down for most agencies and therefore so is value, regardless of the EBITDA multiple. Profit margins are in jeopardy and expense management is not the long-term solution to sustainable earnings growth.

Unlike 2006 and 2007, soft rates are now occurring in tandem with the threat of a weakened economy. A sustained economic slowdown will translate into falling net written P&C premium, given slower growth in property valuations and capital equipment purchases among commercial insureds. A hit to group health and workers compensation commission income will result from lower growth in staff and payroll. These factors will limit the growth capability of independent agencies that have not built a sales culture.

The solution to the problem is organic growth, which is primarily driven by new business production. During 2007, the average agency generated new business production of 15.3% of 2006 commission income. New business production by the same measure in 2007 reached 23.2% of 2006 commission income in the best 25% of agencies. Agencies that cannot net at least 8% growth on an ongoing basis could potentially see falling agency valuations and owner investment returns.

The past: supply and demand

For decades prior to 1995, agency value hovered between 5.0 times and 6.0 times EBITDA. Quite simply, public and large regional insurance broker demand was on balance with the supply of sellers.

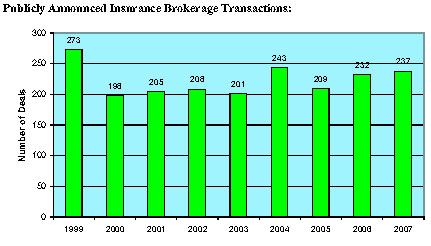

Over the past 10 years, buy-side demand has exploded as banks entered the picture, followed by private equity firms. Since January 1999, there have been more than 2,000 publicly announced insurance agency and brokerage transactions. The number of closed transactions remained relatively stable each year, hovering between 200 and 270. More buyers and limited sellers boosted prices. Supply probably would have subsided, but the consistent increase in prices coaxed many owners to the deal table.

The feeding frenzy that pushed up valuations and allowed agencies on the bubble the opportunity to ride the wave of premium value has continued in early 2008. Prices for agencies, however, are predicted to start to relax toward the end of 2008 or in early 2009 as supply increases and demand flattens. The future will see deal pricing more aligned with economic value versus strategic value. This trend will be no different from what banks are now seeing. The days of selling a bank for an average of 3.0 times book is a bygone era, and 1.75 times book in a bank sale is quickly becoming the norm.

The future: supply and demand

Acquisition supply is increasing. For years, sellers on the fence were pulled along by an increase in deal pricing and the entrance of alternative buyers. We believe the tipping point will occur during the next three years as the industry witnesses a shift—an exponential increase in sellers and a retrenchment in the number of buyers. The number of sellers has ballooned during the past nine months, and there are now more deals in process than at any other time in the past five years. There are at least five main factors driving the exponential increase in the number of sellers:

1. The average agency is getting larger. Over time, a larger portion of the market is comprised of agencies at or greater than $5 million in revenue, which is rapidly becoming the minimum revenue size for public brokers and banks to support as a branch office. The number of acquisition candidates of this size will continue to increase over the next 10 years.

2. The difficult rate environ-ment and the challenge in orchestrating a sustainable organic growth plan are prompting many agencies to sell. Agency owners are concluding that they do not have the personnel or capital resources to fund continued growth.

3. The threatened increase in the capital gains rate has created a tidal wave of sellers. Judging by election-year economic propaganda, promises and postula-tion, the long-term capital gains rate could potentially increase from 15% to upwards of 30%. Regardless of what eventually happens, fear prompts action. The long-term capital gains rate is the lowest it has been since before the great depression.

4. The threat of national health care. While the proposals are fuzzy at best, many agencies with a sizeable book of health business fear having commission income legislated off their income statements. While national health care may never happen, many agency owners believe that the public commentary that is projected to increase regarding a potential change will increase the perceived risk to this line of business and uncertainty alone will reduce value. Many owners are striving to capture value while valuations and demand for this line of business are at an all-time high.

5. The projected overall decline in agency valuation predicted to occur during the next three years. Many agency owners who are not willing or able to embrace profitable organic growth are looking to secure premium value while times are good.

As supply increases, buy-side demand will start to subside. Those buyers that remain and are committed to insurance will continue to close deals, but the overall number of institutional buyers is fading. Potential buyers include:

Banks. The number of insurance acquisitions by banks has declined considerably and will continue to decline. Many bank-owned agencies have performed well ahead of the market. Overwhelmingly, those banks that bought quality agencies are pleased with their insurance operations and returns. However, the virtual collapse of the credit market, liquidity concerns and the hit to bank valuations has wreaked havoc. Conversations in many banks are now squarely aimed at refocusing on their traditional core business products, leaving insurance brokerage business in its wake for at least the foreseeable future.

The retrenchment is aided by a false perception that all banks are divesting their insurance operations. There have been insurance brokerage divestitures from banks like BNC Corp., Capital One, Webster, Bank of America, Citizens, Union Bank of California and Commerce. Some banks will sell to secure capital and divert that capital back to their core business, while others will divest because of poor performance.

Some will sell due to the inability to bring the insurance operation to a scale sufficient to qualify as a material line of business or because of a general lack of board support on initiatives that are not core. There will be bank insurance deals by banks already in the business and banks that desire to enter the business, but bank demand as measured in terms of number of buyers has dropped off.

Private equity. In 2007, private equity firms spent more than $4 billion to acquire and integrate insurance operations. In 2008, private equity firms spent more than $100 million on insurance brokerage acquisitions. Although USI, HUB and Ascension all consummated deals and have the capital to continue executing their business plan, the mortgage meltdown has trickled down to an overall credit crunch in the private equity space. Many private equity firms are now suffering from expiring credit lines that are not being renewed. Debt remains available, but the cost of debt has gone up and the willingness to fund leveraged buyouts has gone down.

Consequently, many private equity deals in the final stretch with periphery private equity players are either being rewritten or rebuked. Though the private equity movement is far from dead, the pace will revert back to what it had been for decades. The groundswell of private equity interest has dissipated.

Public broker buyers. Public brokers were the big winners in the acquisition market last year. A run-up in their deal pricing and the willingness to creatively structure deals fueled their success, but their flexibility and aggressiveness rested on the brokers having no choice. The competition for deals has been so intense that a reduction in pricing or inflexibility in terms would have meant fewer deals, which was not an option given their own weak organic growth. Pricing levels required to close deals will be more difficult to sustain because of the recent hit to their own public valuations.

Most public brokers have rolled out expense-cut strategies to help the math, but the air is getting too thin at current deal pricing. During 2007, the public brokers were buying at 7.0 to 8.5 times EBITDA, which in many cases was more than the level at which they are now trading. Excluding Marsh (which has not been acquisitive in recent years), the average public broker was trading at 7.3 times during mid-March 2008 (enterprise value as a multiple of EBITDA). Over the long run, no public company can buy at multiples that exceed their current trading multiples, as they cannot survive closing deals that are dilutive to earnings.

Fueled by the Willis HRH deal pricing, public broker valuations have improved and trading multiples are again above purchase multiples. But the public to private spread remains very narrow. The Willis HRH announcement, which eclipsed 11 retrospective EBITDA, yet again justified that there is premium value to be had. This event and the collateral impact on public broker value will delay the softening of overall agency value, but the other market forces remain and value decline is inevitable during the next three years.

Public brokers will continue to dominate the acquisition landscape during the next three years. With a growing inventory of sellers and less buyer competition, public broker acquisition pricing for the majority will start to subside and premium value will be captured by only the better agencies. n

The authors

John M. Wepler is president and Patrick T. Linnert is executive vice president, of Marsh, Berry & Co. Inc., a management consulting and deal advisory firm working exclusively in the insurance distribution space. For additional research, please review www.MarshBerry.com/Spring2008StateofIndustry. They can be reached at (440) 354-3230 or at john@marshberry.com or patrick@marshberry.com.

|