|

PF&M at a Glance

Intentional acts

Regardless of the line of business, the applicable insurance policy’s wording addresses the type of incident it intends to cover and, conversely, what it bars from coverage. Essentially, insurance policies are designed to cover certain types of accidents that create a tangible loss. The loss could be suffered by the policy owner (first-party incidents) or by other persons (third-party incidents). In either case, policies typically exclude situations that are intentionally caused by a person insured under the applicable policy.

The assumption underlying the exclusion is that an intentional act is, well, intended, so it is not an accidental occurrence. The anti-accident rationale may appear to be quite clear-cut, but that may not be the case. In years past, the exclusion was fairly subjective. Litigation over such losses that were denied by insurers tended to focus on the actor’s state of mind. In other words, determining whether or not an act was intentional depended on what the person committing the act wanted to accomplish.

Later, insurers changed the wording in their policies so that the exclusion was stripped of much of its subjective stance. Rather than excluding intentional acts, there was a shift to ban coverage for deliberate acts. Insurers justified this change by arguing that, regardless of the harm intended, the fact that the loss was triggered by intentional action should void coverage (as well as, in some cases, a duty to provide a legal defense).

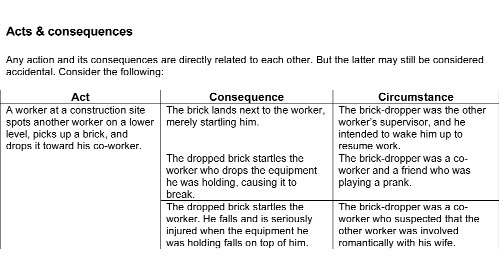

Acts & consequences

Any action and its consequences are directly related to each other. But the latter may still be considered accidental. Consider the table below:

Should a policy exclude any resulting loss without evaluating the circumstances? It is important to be aware of the distinction between a deliberate act and an intentional act. Without taking circumstances into account, the actual purpose and function of an insurance policy may be defeated. With the above scenarios, consideration of a covered loss could change substantially just by mixing and matching the consequences and circumstances.

Consider another example. A father playing baseball in his front yard hits a pitch and the ball sails through a neighbor’s bay window, breaking it as well as destroying an antique painting hanging on the wall opposite the window. The ball was deliberately struck, but the damage to the neighbor’s property was not intended. It may have been foreseeable, but still the loss should be treated as eligible for insurance coverage.

Application of an intentional act exclusion is much more appropriate in losses that involve inherently dangerous items (such as motors, machinery, firearms, poisons) regardless of the consequences. Jurisdictions tend to find that the use of certain items is so hazardous that nearly any harmful consequence should have been foreseen by the actor.

Generally the exclusion is broad enough to also apply to situations where an insured is indirectly involved with an intended act. Specifically the exclusion may apply when an insured either directs or supervises others who commit an intentional act. The exclusion also has an important exception. Coverage (including a right to a legal defense) is available for losses and injuries that involve an insured who is defending him or herself from danger as well as when defending others (or their property). *

|