Gillis, Ellis & Baker is Agency of the Year

They did it their way—the GEB way

By Dennis H. Pillsbury

It seemed somehow fitting that on the heels of Superstorm Sandy, an agency that had not only survived the ravages of Hurricane Katrina but had prospered and helped rebuild its city of New Orleans, was voted Rough Notes magazine's Marketing Agency of the Year. Gillis, Ellis & Baker's inspiring story of its recovery from Hurricane Katrina—a storm that not only forced the entire agency staff to work out of a trailer in Baton Rouge and left 27 of the 37 employees dealing with the complete destruction or significant loss to their homes, while they also faced 3,000 claims that needed to be settled as quickly as possible—led to the agency gleaning the largest number of votes from previous cover agents.

Fortunately for Gillis, Ellis & Baker and for its clients, the agency had developed a strong series of risk management services and educational training—the GEB Advantage Plan (GAP)—that address and provide proactive solutions to its clients' risks and business challenges. The name reflected what the agency saw in the marketplace—gaps in insurance, gaps in safety training, and gaps in the overall management of risk. "It was clear to us that the ability to close these gaps was the key to differentiating ourselves, attracting new clients, retaining our existing clients, and growing the agency," Chairman Parke Ellis, CPCU, says.

The aftermath of the storm provided ample evidence of the efficacy of the GAP approach as 148 of the agency's 150 largest clients were back in business after the storm. "That says a lot about the quality of our service and our understanding of what is needed in the New Orleans marketplace," Vice President and Chief Operating Officer Douglass C. Mills, CPCU, reports. "It also provided excellent fodder for an advertising campaign we ran after the storm."

"More recently," Parke adds, "we have invested in a public relations campaign designed to increase brand awareness and focus on our community involvement."

The GEB way

The GEB Way was born in 2001 when, under the leadership of Parke Ellis and President W. Anderson Baker, CPCU, ARM, the agency made a decision to devise a unique way of doing business that would create true value for its clients. What eventually became GAP grew out of a desire to create a process that would positively impact each client's business in four ways. It was intended to:

• Assure that clients can serve the needs of their customers.

• Keep employees safe, healthy and on the job.

• Protect the company's assets and balance sheet.

• Ensure the company's survival in the short and long term.

And it has helped to fuel the agency's growth as "we've doubled in size twice since it was implemented in 2001, and that was during a prolonged soft market," Parke points out.

After the storm, this approach became even more critical as "our clients really zeroed in on the importance of managing their risks," Anderson says. "Most of our commercial clients saw their property risk move into the surplus lines market. Every renewal had to be remarketed and a solid risk management program was an essential ingredient in finding the best market at the best price."

This renewed focus on risk management and the role of the insurance industry in helping pay for much of the city's rebuilding also created a renewed interest in careers in the insurance industry. "It's unfortunate that it took one of our country's worst natural disasters for people here to recognize just what a great industry this is," Parke notes.

"We've literally had a flood of people who want to work here and we've been able to attract the best people into the fold," Doug Mills adds.

And many of these are younger people. The number of staff under 35 ballooned from three before the storm to 16, including six young producers. "You can just feel the change and excitement," Parke says, noting that the excitement is not confined to the agency. "Revitalization has taken hold."

Since its recognition in our March 2012 issue, the agency has expanded the GEB Way to include personal lines, especially high-end personal lines. "We had a lot of insurance companies that hung in after the storm," Parke notes. "They appreciate our focus on mitigating risk and see its value for personal lines clients."

He continues: "We've also become very proactive in the health care arena. We recently offered a seminar on the changes that are coming down the pike, and more than 100 of our clients attended."

The stimulus

"We're very proud to have been part of an industry that provided most of the stimulus for the revitalization of our city," Parke said proudly after receiving the award recognizing Parke, Ellis & Baker as the Rough Notes Marketing Agency of the Year. "We're just a small part of the story," he added, noting that there were "a number of other agencies that also did a great job for their clients. The recovery and revitalization has been a great American story."

Anderson added that "there are thousands of businesses that did the same thing we did. We were just doing our job. Tonight, the people here who really deserve the accolades are the winners of the Community Service Award. (See May issue, page 74.) They have really gone the extra mile to make the world a better place."

Parke concluded: "I am both humbled and honored that our peers chose to recognize our agency."

|

THE 2013 EDITORIAL BOARD MEETING The day after the Marketing Agency of the Year banquet, the Rough Notes Editorial Board assembled for its annual meeting with members of the magazine's editorial staff. Composed of former cover agents, the Editorial Board shares insights into the key issues that are affecting independent agencies' bottom line. It was not a great surprise that the hardening property/casualty market was a topic of discussion. Last year, the board predicted that there would be modest increases as the year progressed, unless major catastrophic events resulted in steeper increases. Well, we certainly had at least one major catastrophe as Sandy came on shore along the eastern seaboard. But it was late in the year and the January 1 reinsurance renewals apparently didn't reflect those losses. So, again with no particular surprise, there was concern about July 1 renewals. At the same time, all reported that the market definitely was firming, with rates rising by single digits in most lines, but reaching double digits in certain geographic areas and in certain lines, particularly property along the East Coast. Several board members expressed dismay that, while companies were attempting to firm rates for current clients, there remained a number of companies that were competing for new business, placing agents in a very difficult position. "How do you explain to clients that they are being penalized for being loyal?" one agent quipped. Another commented that the companies were feeding customers' propensity to shop around. On the plus side, several agents noted that the approaching hard market really gave them a chance to shine, pointing to two areas in particular that placed them ahead of their competition: An emphasis on loss control. The loss control and risk management services that these agents provide prove their true value when the market hardens. Thanks to their good loss profile, customers see smaller increases than most other insureds and some could even see continuing decreases. Alternative market options. Several board members commented that the current kowtowing to new business mirrored behavior in previous cycles and suggested that those agents who have not already done so need to establish relationships with consultants in the alternative market. One board member pointed out that about 35% of his commercial business clients were in captives. Another said he was working with a group of his insureds to establish a captive. "If your companies won't reward those customers with good loss histories, then the captive alternative may be the way to go," another board member commented. Another area of concern for agents was the Patient Protection and Affordable Care Act. Many of the provisions of the act will be going into effect next year. The agents indicated that they were educating their insureds about the choices they would have under the act and principally taking a 'wait and see' attitude although several said they were 'running to the fire' and taking a proactive approach with clients that wanted to make changes now toward coming into compliance with the act next year. Remote staffing also led to a lively discussion as more and more agents face a plethora of options when it comes to allowing employees to work from home, as well as outsourcing certain functions to organizations that provide staffing. One agent noted that her agency was able to retain low margin business by outsourcing it to a firm in India. It was primarily accommodation business that didn't fit the agency's marketing objectives, but it is being successfully managed by the firm in India. "We're making some money from this business, it's being well served and it's been seamless for our customers," the board member said. Another agent noted that he wanted to offer flexible hours and the opportunity to work from home after the agency moved out of the city to an area that was less accessible by mass transit. "It's worked out very well," he said. "Some people were looking at very long commutes and they're pleased that we've offered them this flexibility." |

Scott Addis of The Addis Group. Roosevelt Haywood III of Haywood and Fleming Associates. Lew Kachulis (left) of Gilbert's Risk Solutions and Tom Cousineau of VAST. |

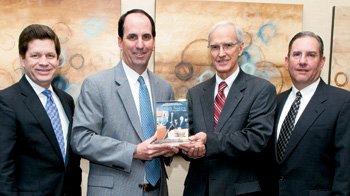

R. Parke Ellis, CPCU, Chairman; W. Anderson Baker III, CPCU, ARM, President; and Douglass C. Mills, CPCU, Vice President & Chief Operating Officer.

Rough Notes magazine's Editor in Chief Thomas A. McCoy presents the Marketing Agency of the Year Award to the Gillis, Ellis & Baker executives.

These are the individuals who worked in the trailer in Baton Rouge after Katrina hit New Orleans. The agency explains "The Spirit of the Trailer," in part, as "Not much was certain, but we had each other and that was enough."

Some of the under 35 crew pose with the new office construction that shows Gillis, Ellis & Baker is continuing to grow.