|

|

|

|

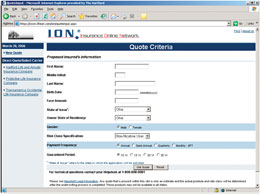

Opportunities in life New PIA program provides members quicker access to multiple quotes of term life through the Insurance Online Network By Bill Jenkins Ask most P-C agents if there are opportunities for their agency in offering life insurance products to clients and they’ll agree that the opportunities are real, available, and profitable. However, when it comes to life insurance sales, many agencies still have unanswered questions. Is it right for my agency since my focus is on P-C? Can I offer my customers the right product choices that coincide with their objectives? Can I really compete with life sales professionals who are already established in this marketplace? To help agencies answer these and other questions, the National Association of Professional Insurance Agents (PIA) recently created its “Opportunities in Life” program. One of the first opportunities this program is focusing on is a new and unique way of bringing term life products to P-C agencies. This new opportunity is the Insurance Online Network, or ION, a Web-based platform designed to make it easier and quicker for professional independent agents to obtain online quotes for term life insurance from multiple carriers. Through this easy-to-use online platform, life insurance licensed agents are able to enter minimal client information and generate term quotes from multiple carriers with the click of a button. Based on the client information entered, ION creates a multi-carrier quote with accurate and complete premiums based on various rate classes, face amounts, payment modes, guarantee period, and other factors. Once the initial quote is generated online, the agent can then discuss various options with the client during a live, online ION session and change various quote options to readjust premium and policy terms. After the agent and client decide on price and terms, ION then transfers the quote directly to the selected carrier’s online request for application system. ION offers professional independent agents a quick and easy means of saying yes to client’s objectives for term life insurance products. Of course, no quote is final until underwriting is completed. Hartford Life¹ and Protective Life² are the founding partners that created ION. Their first additional participating carrier is Transamerica Occidental Life³. These three highly rated companies offer quotes through ION because of the advantages this new platform offers to life insurance licensed professional independent agents. With a single sign-on and at no cost to agents, ION reduces time, effort, and redundancy. It also facilitates choice and the opportunity for agents to present clients with options to consider. It provides access to quality insurers with quality products. And the technology is solid and well-tested offering agents “industrial strength” support with “24/7 - 365” reliability. Many agencies have developed solid approaches to making the most of their own “opportunities in life.” These approaches have not taken anything away from their ability to maintain agency proficiency and customer satisfaction with P-C—but rather serve to enhance satisfaction and keep clients from being forced to look elsewhere for their life insurance needs. In preparation for this article, we spoke with two agencies that have modest life books of business to find out how they are currently meeting client objectives and how this new solution from ION might fit in with their overall approach to life insurance sales. Carl Stoecklin, CIC, CPIA, is president of the Broz Agency in Cincinnati, Ohio. Since Broz is a small agency that has not reached the level of establishing a life and health department, they sell term and other individual life insurance products in-house but refer their more complex life and financial services accounts to a broker. “We’ve had a relationship for years with a broker we can trust,” Carl explains. “Referring complicated business is actually a way of extending our services. I simply don’t have time to keep up with all the tax laws and the products that are available. Whether it’s an equity-based investment product, a whole life insurance policy or variable annuity, we want to enhance our relationships with our clients by offering products that best meet their objectives. It’s the same in the life business as it is in P-C—unless you have full-time people who can devote the time needed, you just can’t keep up with everything you need to.” But for the Broz Agency, when it comes to offering term life insurance products, they don’t have the same problems since they believe they can provide this coverage while assuring and even strengthening the client relationships. As Carl explains: “I haven’t seen the latest figures on client retention, but from what I recall it’s around three to four years if you write one policy with a client. It then jumps to eight or nine years with two policies and then into the double digits after that. So, if we can make a term life insurance sale, we’re ahead of the game with that client. We not only make the sale but stay with our clients through the rest of the process. If they have any questions about the application or the medical exam, we’re there to help. We can provide the value-added our customers have come to expect from our agency.” Another agency with a modest life book of business is the Rocky Mountain Capital Agency in Cheyenne, Wyoming. Liz Luce, ARM, AAI, has worked in the agency for 20 years and has been its owner for the last 12 years. Her agency is 65% commercial and much of its business is with contractors. This also means being involved with bonding which often creates the initial entry point for life sales, Liz explains. “Often the bonds we’re providing require some type of protection for the bonding company’s liability. In many cases this involves term life insurance,” she points out. “Many of our clients who are small business owners are in their thirties and are starting to recognize the real need to protect their families and their assets. We can help them get started with term life coverage because it’s affordable and then they can grow into some type of universal policy which would combine life insurance protection with cash. There are a lot of possibilities.” According to Liz, long-term client relationships are also paramount at Rocky Mountain Capital. “I closely monitor our retention figures month-by-month. We’re in the relationship business which means that whoever writes life insurance business in our agency receives a commission—but they’re also personally responsible for completely following through with that client. This is because we strongly believe that if we do what’s best for our client, then that’s what’s best for us as well.” But both Carl and Liz agree, the capabilities that ION will soon make available will enhance their activities in this area. From Carl’s perspective it’s a winner. “Fifteen years ago at least six of our carriers offered life insurance products. Now we’re down to two and in many cases they’re not competitive on certain risks. I think this new platform can be very useful for us. If we can provide a quote for term life insurance and it’s accepted, then we say ‘come on in.’ If we can make the sale, then I say, ‘just do it!’” Liz shared Carl’s enthusiasm, stating that, “This will be a very efficient use of our time and our client’s time. It will be great to get three quotes at once instead of entering the data separately for each carrier, then pulling up each one on the computer to make a request for a quote. We would love it.” * Author’s note: Access to the Insurance Online Network is available to PIA members through the Main Street Store at the PIA National Association Web site at www.pianet.com. ¹ The Hartford is The Hartford Financial Services Group, Inc., and its subsidiaries, including the issuing companies of Hartford Life Insurance Company and Hartford Life and Annuity Company. ² Protective Life Insurance Company (PLICO) is a subsidiary of Protective Life Corporation, which is a separate company and not responsible for the financial condition or contractual obligations of PLICO. ³ Transamerica Occidental Life is Transamerica Occidental Life Insurance Company, Cedar Rapids, Iowa 52499. The author |

|

|||||||||||||||

| ||||||||||||||||