|

SPECIALTY LINES MARKETS Hospitality industry Hotels, bars and restaurants By Larry G. France

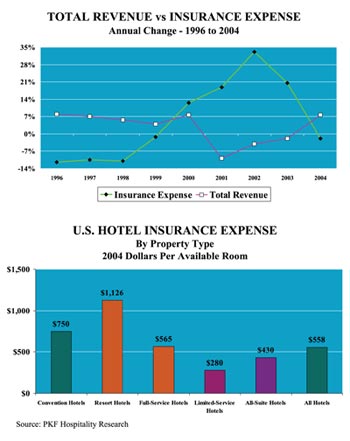

Insurance premiums have become the fastest growing expense for U.S. hotel owners, according to PKF Hospitality Research (PKF-HR). Despite a slight decline in 2004, the payments made by hotel managers for general liability and property insurance have more than doubled since 1999. Given the impact of recent natural disasters, as well as the continuing threat of terrorism, it is feared that this cost will continue to rise at a greater pace than other expenses in the future. This conclusion comes from the recently released 2005 edition of Trends in the Hotel Industry, published by PKF-HR, an affiliate of PKF Consulting. “Insurance can be classified as a minor expense,” says R. Mark Woodworth, executive managing director of PKF-HR. “In 2004, it averaged just 1.9% of all hotel operating expenses. However, because this cost has doubled in recent years, it has caught the eye of hotel owners and operators.” In 1999, insurance payments averaged $265 per available room, or 0.7% of total revenue. By 2004, this expense grew to $558 or 1.4% of total revenue. “The 1.8% decline in insurance costs in 2004 means very little after seeing annual increases in excess of 20% and 30% following 9/11, Woodworth points out. The 2005 Trends in the Hotel Industry is the 69th annual review. Insurance expense is just one of 200 discrete hotel revenue and expense items used to compile the study. This year’s sample draws upon year-end 2004 financial statements from more than 5,000 hotels across the country. While there was a slight decline in insurance costs during 2004, PKF-HR is monitoring a couple of factors that unfortunately indicate a continuation of soaring premiums. “Not included in the 2004 insurance statistics are the costS for Florida hotels that were permanently or partially closed due to the hurricanes,” Woodworth explains. “Early indications are that the insurance costs for these properties have started to rise dramatically in 2005.” Copies of the 2005 Trends in the Hotel Industry report are available at www.pkfc.com; or call Claude Vargo at (866) 842-8754. Reaching the market

Two steps to marketing a specialty product are defining what part or niche you want to carve out and selecting the product you want to offer. It is very difficult for most markets to write all risks across the board in any class. “Hospitality business is very Main Street and, as a result, there are always a multitude of carriers who write these classes,” according to Lois J. Massa, vice president of sales, GE Insurance Solutions. Massa says the challenge for a disciplined carrier is “to find the ‘right’ segment within the broader definition of hospitality. Those who are less reactive to pricing and more focused on risk management and long-term relationships with their carriers make the best partners. The principal threat to such a market segment is when naîve competition enters the marketplace and under-prices business in order to meet short-term gross written premium goals.” Massa points to a number of sources and internally determined information that were used by GE Insurance Solutions to determine that its niche would be business and short-term leisure stay properties, including: • The Travel Industry Association of America expected business travel to experience a 3% increase in 2003 followed by a 5% jump in 2004, after several years of decline. • The American Hotel and Lodging Association says there are 47,000 hotels with 15 rooms or more in the United States, representing 4.4 million guest rooms (2004 Lodging Industry Profile); the average room rate is $83 per night and the occupancy rate is 61%. • The typical traveler is male (71%), age 35-54 (53%), on business travel (52%) with an average income of $83,000 and an average length of stay of a little over one night (40% stay for one night). • The majority of hotels are suburban (39%) or located near a highway (38%) with fewer than 75 rooms (58%). GE Insurance Solutions has partnered with Klein Insurance Services, providers of hotel programs since 1990, to launch a new program. (See contact information for Klein in the listings following this article). The program is multi-line property/casualty coverage for both limited service and full-service business hotels. Full-service hotels may house or operate newsstands, drugstores, beauty and barber shops, gift and clothing, and restaurants/lounges. Limited services hotels, as their name implies, offers fewer services. The program does target resorts, residential hotels, conference/convention centers and business hotels. The state of the market Alan Dudkiewicz, CIC, of Jimcor Agencies says, “We have seen softening in property rates and several markets have responded to retain existing accounts and aggressively write new accounts. Capacity continues to be readily available in coastal and non-coastal areas. Builders risk and renovations coverage has also grown dramatically as hotels and motels perform remodeling to modernize their facilities.” Restaurants, bars and taverns Restaurants, bars and taverns have historically been a line that can be hard to place. Some of the reasons include the fact that businesses in this class have a tendency to fail because of inexperienced ownership and improper financial planning. Another factor that has made them hard to place is that very few markets understand the class, offer a policy that both the client and carrier can live with, and price the product at a point where the carrier can make a profit at premium levels that are affordable. Fred Jackson, CIC, vice president at Risk Placement Services (RPS) in Lexington, Kentucky, says, “A large segment of this class of risk has consistently been written in E&S market from the upscale white table cloth operation to the small neighborhood tavern.” Jackson continues that RPS has written this type of business for more than 30 years and continues to look for new business, providing a full package or monoline product. “Carrier appetites do vary somewhat, usually based on the experience of the proprietor, sales percentages of food versus alcohol, types of entertainment being offered, the age of the clientele, hours of operation and the length of time in business,” Jackson explains. “These all influence the acceptability of the risk as well as the prior loss history on the account. These variables are usually the determining factors in which markets are willing to offer coverage terms.” Jackson’s list of important underwriting factors includes: financial stability; maintenance and upkeep; lighting and egress (evacuation accessibility); security; and dispensing of alcohol. “Although this class of risk presents certain unique underwriting issues, it can be a very lucrative and profitable line of business if underwritten properly,” says Jackson, “Agents who do their homework on risks before presenting them to an underwriter certainly have a much greater chance of success than those who do not.” Detailed information on this program can be found at www.RPSINS.com. Overall the market for hospital-ity business appears to be very accessible and ready to do business for those providing adequate under-writing information. Updates on this and other lines of business can be found on The Insurance Marketplace Specialty Lines Bulletin Board located on www.roughnotes.com. Future Specialty Lines articles include Special Events (prize indemnity, promotions and contest) in May, EPLI in June, and Personal/Commercial Umbrella for July. The following have responded to our survey and indicated that they are a market for hospitality risks. Note that the listings will guide you to target classes, areas of operation and contact information. Arlington/Roe & Co., Inc. Bohrer, Croxdale & McAdoo, Inc. An MGA operating in AR, IL, IA, KS, KY, MO, NE, OK and TN with limits of $1 million/$2 million/$2 million. Target classes are bars, hotels, resorts, campgrounds, restaur-ants and nightclubs. Can offer umbrella. Carriers are Capitol Indem-nity, Capitol Specialty, Scottsdale, Northland, Maxum, Atlantic Casualty, and National Fire & Marine. Burns & Wilcox Ltd. An MGA/E&S broker that operates in all states except AK, HI and NY with liability limits of $5 million and property limits of $10 million. Will consider all classes. Can offer EPLI, crime, liquor liability and food spoilage. Scottsdale, Lloyd’s, USLI, Burlington, Colony, and Essex are the carriers. CalSurance, Brown & Brown of CA, Inc. An MGA that offers national programs throughout the United States with limits of (hotels) $50 million to $100 million excess/umbrella; pizza, $2 million/$4 million GL and $1.5 million delivery liability. Target classes are hotels, resorts and pizza operators. Can offer property, casualty, excess and EPLI for hotels; property, casualty, auto including delivery, and workers comp for pizza operators. Fireman’s Fund is the admitted A rated carrier. Capitol Insurance Companies An insurance company whose target classes are property/casualty, surplus and surety. Will not consider auto or contract surety.Capitol is an A rated company. Crusader Insurance Co. An insurer that operates in CA only with liability and property limits of up to $2 million. Target classes are bars/nightclubs, restaurants, micro breweries and hotels/motels. Can offer liquor legal liability. Crusader is rated B+. Evolution Insurance Brokers (EIB International) An E&S broker that operates nationwide with all limits. Will consider all classes. Prime Insurance syndicate is a B rated carrier. Gary Markel Surplus Lines Brokerage, Inc. An MGA/E&S broker that operates in FL only with limits of up to $25 million. Target classes are bars, restaurants, nightclubs, and hotels/motels. Will not write auto or workers comp. Can offer GL, property, liquor, umbrella, EPLI and innkeepers legal. Various A rated surplus lines carriers are used to place coverage. H.R. Keller & Co., Inc. A wholesaler/E&S broker operating in NY only with limits that vary by company. Target classes are restaurants, taverns, nightclubs, and gentlemen’s clubs. Can offer liquor legal liability, workers comp, DBL and equipment breakdown. Both admitted and nonadmitted carriers are used to place coverage. ICAT (International Catastrophe Insurance Managers, LLC) An MGA that operates in 36 states with limits that vary depending on the product and capacity. Target classes are hospitality, office, mercantile, municipality for general commercial, and hard-to-place exposures for hurricane and quake. Builders risk and homeowners for hurricane only. XL Capital Group (A+), National Fire & Marine (A++), and Lantana (A-) are the carriers. Insurance Center Special Risks Ltd. An MGA that operates in CT, MA, NH, RI and VT with in-house liability limits of $1 million/$2 million and property limits of $800,000. Target classes are family-style restaurants and neighborhood bars. Will not write nightclubs or bars with live bands. Can offer business income, food spoilage, liquor liability and umbrella. Essex and Lloyd’s are the A rated carriers. Insurance Innovators Group An MGA/E&S broker that operates in DE, MD, NJ and PA with limits of $1 million/$2 million/$1 million. Can offer umbrella, excess property, GL and package. Various carriers are used to place coverage. Izzo Insurance Services, Inc. An MGA/wholesaler that operates in all states except HI with limits of $1 million. Target class is hotels/motels. Serves as a monoline workers comp and EPL market for this industry. All carriers are rated A or better. James River Insurance Company Jimcor Agencies An MGA/E&S broker that operates primarily in DE, MA, NJ, NY, OH, PA and WV with primary GL limits of $1 million/$2 million, plus excess/umbrella; and property limits of $25 million and up. Target classes are bed and breakfasts, individually owned or franchised hotels/motels, travel lodges, seasonal risks, restaurants and bars/taverns. Will not write workers comp or auto liability. Can offer innkeepers liability, liquor liability, bailees coverage, restaurants, hired and non-owned liability, and swimming pool exposures. All carriers are A rated or better. Klein Insurance Services, Inc. An MGU that operates in 48 states. Target class is hotels. Insurance Corporation of Hannover and Westport Insurance are the carriers. McLeckie Insurance Group An MGA/E&S broker that operates in all states with limits as required. Target classes are hotels, resorts, motels and restaurants. Will not write bars and clubs. Various carriers are used to place coverage. Midlands Management Corp. An MGA that operates in AR, KS, OK and TX with limits of $2 million general aggregate. Target classes are restaurants, bars and taverns. Will not write liquor liability or bars with bouncers. Can offer property. Essex (A) and Wellington Specialty (A-) are the carriers. Motel Insurance Brokers A program administrator and E&S broker that operates in most states with the following limits: GL, $1 million/$2 million; property, $25 million; liquor, $1 million; umbrella, up to $25 million. Target classes are hotels and motels. Can also offer property, GL, crime, liquor liability, umbrella and equipment breakdown. Will not write extended stay and long-term rentals. Various A rated carriers are used. National Specialty Underwriters, Inc. A program administrator and E&S broker operating in all 50 states with limits of up to $260 million with umbrella. Target classes are hotels, resorts and casinos. Will not write stand-alone restaurants or bed and breakfasts. Can offer GL, auto, property, workers comp, umbrella, boiler & machinery, crime & fidelity, liquor, and EPL. Tokio Marine, St. Paul Travelers and The Hartford are A+ rated carriers; Zurich North America is rated A. NIF Group, Inc./NIF Pro An MGA/E&S broker that operates in the eastern United States with limits of $1 million/$2 million plus umbrella. Target classes are risks requiring specialty coverages or not insured in the standard market. Can offer liquor liability, special events, and umbrella. All carriers are A rated. Philadelphia Insurance Companies An insurer that operates in all states except LA with limits of up to $10 million with umbrella. Target class is interior corridors (if frame or joisted masonry, must be 100% sprinklered). Will not write non-sprinklered hotels. Can offer liquor liability. Philadelphia Indemnity is the A+ rated carrier. Prime Insurance Syndicate Inc./I.E.B.S. An insurer (Prime) and MGA (IEBS) that operates nationwide with all limits. Will consider all classes. Can offer monoline liquor coverage, assault & battery, after 3 a.m. closings in the hospitality industry. Prime is a B rated company. Professional Liability Insurance Services, Inc. A national program administrator that operates in all states with various limits. Target classes are restaurants or hospitality companies; available for any type or size of service operation. Can offer EPL, miscellaneous E&O and lawyers professional liability. Lloyd’s is the A rated carrier for all product lines, except Service Lloyd’s (for lawyers professional liability, an admitted product) which is rated A-. R.J. Bostick & Assoc. An MGA/E&S broker that operates in various states with various limits. Target classes are bars, restaurants and hotels/motels. Can offer D&O and EPL. Various carriers are used to place coverage. Restaurant Owners PG, Inc., c/o S.H. Smith & Co. An E&S broker that operates in all states with limits of $1 million and up. Target classes are restaurants, bars/taverns, and hotels/motels. Can offer EPL, workers comp and liquor liability. Roush Insurance Services, Inc. An MGA that operates in IL, IN and OH only with liability limits of up to $10 million and property limits of up to $10 million. Will consider all classes. Can offer liquor liability, special events, inland marine and equipment breakdown. The A rated carriers are Century Surety, Essex, Evanston, Scottsdale, and Atlantic Casualty. Russell Bond & Co., Inc. An MGA/E&S wholesaler that operates in CT, NJ, NY and PA with GL limits of up to $3 million plus excess limits up to $10 million; no limits on property. Will consider all classes. Can offer liquor, umbrella, EPL, workers comp, excess and hired & non-owned. All carriers are rated A- or better. S.I.U., LLC An MGA/E&S broker that operates in AZ, CA, NV and OR with GL limits of $2 million/$2 million, and property, monoline or packages and excess liability limits of $5 million. Target classes are hotels/motels, restaurants, bars and resorts. Will not consider nightclubs. Can offer inland marine, equipment breakdown, employee benefits liability, and restaurant enhancement package. Carriers are rated A- or better. Southern Hospitality Underwriters, Inc. A program administrator that operates in all states with GL limits of $1 million and property limits of $10 million. Target class is hotels (both limited or full-service). Can offer umbrella and EPL. All carriers are A rated. Specialty Insurance An MGA operating in CT, DE, FL (no property), GA, IL, MA, MD, MI, MN, MO, NJ, NY, PA, RI and TN with liability limits of $1 million, property limits of $4 million (higher limits available), liquor liability of $1 million, and umbrella as needed. Target classes are restaurants, taverns/bars, pizza parlors, carry-outs, and caterers. Will not consider hotels/motels. Can offer comprehensive enhancement endorsement and utility services (off-premises power failure). QBE is the A rated carrier. Unifax Insurance Systems, Inc. An MGA that operates in CA only with liability and property limits of up to $2 million. Target classes are bars/nightclubs, micro breweries, restaurants, and hotels/motels. Can offer liquor legal liability. Crusader is the B+ rated carrier. United Brokers Inc. An MGA that operates in AL, AR, GA, IA, IL, IN, KS, KY, LA, MA, MD, MI, MN, MO, MS, NC, NJ, NV, OH, OK, SC, TN, VA, WI and WV with GL limits of up to $3 million. Target classes are bars/taverns and restaurants. Can offer liquor and equipment breakdown. Carriers are USLI (A+), Evanston (A+), and Penn Star (A-). W.A. Schickedanz Agency, Inc. An MGA that operates in AR, IL and MO with GL limits of $1 million/$2 million binding; property limits of $1.5 million binding; excess available brokerage; liquor liability $1 million. Target classes are local taverns, restaurants, special events, and riverboat casinos. Can offer food spoilage, crime, and hired/non-owned auto. Lloyd’s is an A rated carrier; A- rated carriers are First Financial, Acceptance Casualty, and Burlington. W.H. Greene & Associates An E&S broker that operates in NY state only with CGL limits of up to $1 million/$2 million; property of up to $1 million in values, and umbrella up to $10 million. Target classes are hotels/motels (four stories or fewer; pools/beaches okay), and family-style restaurant with or without bars. Will not write risks with bouncers or security, risks with delivery, hostess bars, property for risks with unprotected cooking, apartment motels/hotels, and ski resorts. Can offer umbrella and liquor liability (separate policy). All carriers are A rated. Western World Insurance Co. An insurer that operates nationwide with GL limits of $1 million/$2 million. Target class is smaller, lighter risks. Will not write liquor liability or bars/taverns. Can offer GL, property, and floaters. Western World is an A+ carrier, as is Tudor. Willis Programs An MGA that operates throughout the United States and in Canada with primary limits of $1 million and $100 million excess. Target classes are destination resorts, hotels, spa & boutique hotels, condo hotels, 4&5 luxury hotels, timeshare, vacation clubs, and large HOAs. Will not write bed and breakfasts, roadside motels or residential condos. AIG and Chubb are the A++ rated carriers. Yates & Associates Insurance Services, Inc. An MGA that operates in CA only with various limits. Will consider all classes. Can offer liquor liability and EPL. All admitted and nonadmitted carriers are A rated. * |

||

|