|

PF&M at a Glance ISO Liquor Liability Policy

Company A and Company B are profitable businesses that make roughly $1 million annually. Company A has fewer than 50 employees while Company B has more than 100 on its payroll. The two operations are insured by commercial general liability (CGL) policies and they face a similar problem. Late last year they both held holiday parties on their premises. Liquor was served at both events, and each company is being sued because of a drunken employee’s post-event actions. It is here where the two situations differ—drastically. Company A reports the incident to its CGL insurer; the carrier gets details and begins to provide a legal defense of the suit. Company B reports the incident to its CGL insurer and the carrier promptly sends a registered letter denying coverage. Why the difference? Company A is an office supply/stationery outlet. Company B is a large, wholesale beer and wine distributor. While a CGL is a very flexible coverage package that can even cover alcohol-related losses, it is quite rigid under a given condition. The policy excludes claims connected to the use of alcohol when the insured operation has anything to do with alcoholic beverages. So if the insured company sells, makes, stores or distributes liquor, it needs the protection offered by a liquor liability policy. In this case, we’re discussing the Insurance Services Office, Inc. (ISO), Liquor Liability Coverage Program.

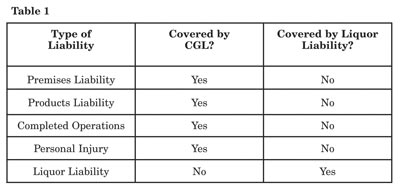

The insuring agreement of the liquor liability coverage form obligates an insurer to pay for certain damage or injury that is due to an insured’s serving or selling/furnishing alcoholic beverages. No other liability coverage is provided by this form, so it dovetails, rather than replaces a general liability policy (see Table 1). It is important for the insured to maintain a commercial general liability (CGL) policy in addition to the liquor liability. Any person or organization can purchase the coverage provided by this policy. There is no specific eligibility. There is no requirement that the insured be in the business of manufacturing, distributing, selling, serving or furnishing alcoholic beverage. A wide variety of businesses need to carry liquor liability coverage to handle their exposure to loss involving on-premises or off-premises (or a combination of) alcohol consumption. Such businesses include: Naturally, the biggest exposure consists of negligently serving or furnishing alcohol to a person who, in an inebriated state, causes serious damage or injury. Example: MetroSportz Bar is sued by John and Joan Viktum. A few months earlier, the Viktums joined some friends at MetroSportz to watch their favorite out-of-town football team play the Metroville Meteors. The Viktums heroically dealt with a small, drunken group of Meteor fans who gave them a hard time during the televised game. After the Viktums’ team beat the Meteors, the couple paid their tab and left the bar. Before they could get to their car, the drunken Meteor fans chased them down and gave both Joan and John a serious beating. The Viktums named MetroSportz in their lawsuit, alleging that its bartenders continued to serve alcohol to a group of angry and clearly intoxicated patrons. MetroSportz’s owner sent the legal papers to its liquor liability insurer for handling. There are no specific eligibility rules concerning the type of business that is acceptable for liquor liability coverage. From an underwriting standpoint, insurers would be most concerned about the reputation of an applicant business. What would be critically important is an operation’s loss history as well as any information about violations such as serving minors. Typically insurers emphasize that insureds and applicants place a high priority on properly training persons responsible for serving or selling alcohol. It is also important that a business or operation has guidelines on dealing with intoxicated customers. As is the case with other lines of insurance, endorsements are available for molding a basic liquor liability policy to better fit a particular insured. Rating the premium for a liquor liability policy depends upon a given business classification and its annual receipts from liquor sales. Please note that this is only an overview of this coverage. A thorough discussion of this coverage form may be found in the PF&M Analysis from The Rough Notes Co. Inc. Agency OnLine subscribers, please refer to PF&M Section 277.4-2, ISO Liquor Liability Coverage Forms Analysis. * |

||

|