|

|

|

24th annual Rough Notes Who will be the 2012 Agency of the Year?

One of the agencies featured in a Rough Notes cover story during 2012 will be chosen Marketing Agency of the Year. The agency principals of the winning firm will be presented with the award at a dinner held in their honor this spring. The winner will be selected by votes of the previous 23 years' Rough Notes cover agents (from the years 1989-2011). The nominees for this year's award are described on the following pages. The winning agency will be announced in the February issue of Rough Notes, and a full story on the winner will appear in a future issue.

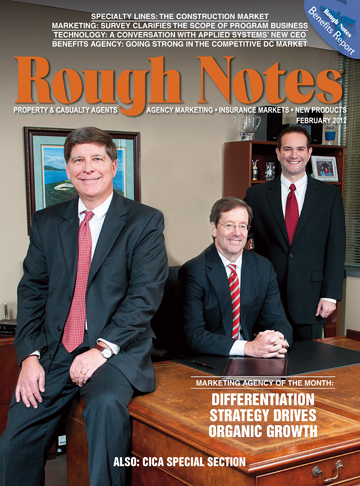

February

Three industry veterans—two from HRH, one from an insurance company—formed S.S. Nesbitt & Company in 2000. They brought with them a few large accounts from HRH, and within two years they had developed a book of business generating $1 million in revenue. Today the agency has reached $10 million in revenues, with 61 employees. More than half of its growth has been organic, with the balance coming from three acquisitions it made from 2006 to 2008. One of the acquisitions was a firm with benefits expertise, which has served as a springboard for cross-selling opportunities from benefits to P-C business. Nesbitt's benefits expertise has been further strengthened by recent hirings of an HR specialist, who came from a 1,000-employee company, and a registered nurse, who helps the agency develop wellness programs. The agency stresses a consultative selling strategy. For one client, a medical center that is the largest local employer, the agency recommended coverage enhancements that resulted in a 50% reduction in workers compensation costs. The CEO of the medical center summarized S.S. Nesbitt's approach by saying, "They want to make sure we are okay today, and they also want to make sure we are okay 10 years from now." Key niches that have contributed to the agency's growth are student housing, medical facilities and country clubs. Selina Simpson, one of the agency's founding partners, heads up the student housing niche, supported by Claire Wright, vice president of operations, who came to Nesbitt from a large client that built student housing.

March

When is "The Big Easy" not so easy? When a deadly hurricane ravages its vulnerable coastline, floods 90% of the city, and leaves behind a swath of loss, death, and destruction. That's what happened in New Orleans on August 29, 2005, when Hurricane Katrina roared across the Gulf of Mexico and scored a direct, devastating hit on the low-lying city. In the aftermath of the storm, the staff of independent agency Gillis, Ellis & Baker, Inc., faced a seemingly insurmountable challenge: how to help their clients when their office was inaccessible, the phone lines were flooded, and no Internet service was available. What's more, 27 of the agency's 37 employees had suffered severe damage to or outright destruction of their own homes. Putting aside their own concerns, the employees headed to Baton Rouge and by September 2 were working out of a fully equipped office in a trailer. They began to settle claims as quickly as possible so that clients could return to their homes and businesses. The agency's commitment to providing solid risk management advice paid off; after the storm, 148 of its 150 largest clients were still in business.

The rebuilding and revitalization of New Orleans is eloquent testimony to the determination of its citizens—and to the dedication of people like the employees of Gillis, Ellis & Baker, who in the face of their own horrific losses devoted themselves to helping their clients recover from Katrina's wrath. Since 2005 the agency's staff has grown to 47, and it continues to play a vital role in the rebirth of a city that refuses to quit.

April

There's something special going on in Fairlawn, Ohio, according to Gordon Wenner, president and CEO of Jones & Wenner Insurance Agency, Inc. "We have the perfect blend—great people and a great system," he proclaims. The agency leverages technology, which Wenner says allows staff to spend more time developing relationships with clients and helping them achieve their risk management goals. Founded in 1975, Jones & Wenner has always placed an emphasis on partnerships and serves only those commercial clients "whose businesses and industries we know in depth," he notes. An important specialty for the agency is trucking and hauling and other kinds of transportation. That depth of knowledge is fortified by the agency's activities in the associations that serve the transportation niche. "We speak their language," says Vice President Sarah Wenner Bloomhuff, a producer who specializes in transportation. "We understand their business and are able to help them with the numerous state and federal filings that are required. When they need information for those filings, they need it immediately." The agency's 24/7 service model satisfies the needs of its transportation insureds. All the agency's customers, in fact, have real time access to their accounts, if they choose, so they can produce certificates or ID cards whenever they need them. Additionally, e-signatures are accepted, making it possible for transactions to be completely paperless.

Wenner points out that this blend of knowledge and service results in a high retention rate and a steady stream of referrals.

May

In the old cities of the Northeast, brownstone buildings are highly prized for their solid construction and classic architecture, and they command hefty prices in the real estate market. These handsome structures, however, may be less than appealing to many standard homeowners insurers. That was the experience of John Cassara, who in the 1970s bought a brownstone in Brooklyn, New York, and had trouble finding insurance for it. He discovered that underwriters tended to shy away from brownstones because they were older buildings, had flat roofs, and often were in transitional neighborhoods and had multiple tenants. Cassara knew that his friends and neighbors were, like himself, responsible brownstone owners who cared about their buildings and were committed to maintaining them. To meet their needs for insurance, he started the Brownstone Insurance Agency in 1973 with a focus on underwriting brownstone owners rather than the buildings. Several years later, Cassara took his successful approach to fellow agents Wayne Fick and Glenn Montgomery, and the men launched a similar agency in the Boston area. They created a program for brownstone buildings and found a carrier that was willing to write it. The agency is the program administrator and places business on behalf of retail producers.

An affiliate, Murphy-Jordan Insurance Agency, was established to meet the personal lines needs of brownstone owners. An entrepreneurial spirit, a relish for solving problems, responsive service, and robust investments in technology are key factors in the success of this niche market specialist.

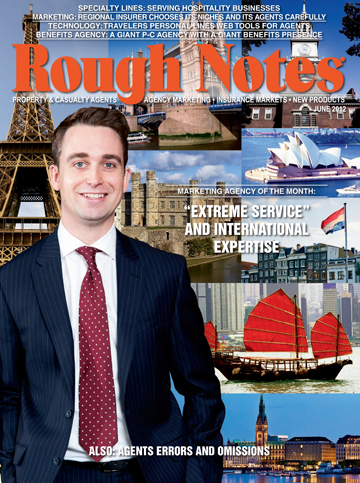

June

Personalized risk management services, coupled with an original philosophy that emphasizes "Don't over-sell", are what have helped make a winner of Bartlett & Co. of Philadelphia, Pennsylvania. Company President Richard F. Bartlett, ACA, ACII, points out: "There is a strong movement here to elevate the insurance broker to the level of a business's lawyer or accountant. . . . Our entire philosophy is built on our becoming a key partner in each of our clients' businesses, providing them with important risk management advice that will ultimately improve their bottom line." For example, Bartlett challenged companies' tendencies to pay small claims (e.g., slip and falls) after research indicated that "word of mouth" had encouraged fake "slips." Both providers and clients profited from a reduction in the numbers of such claims. Such "extreme service" is part of Bartlett's risk management package that includes risk identification, an analysis of the insured's current coverage, and the creation of a custom risk management and insurance program, as well as periodic follow-up meetings. In addition, because Bartlett's thrust is international in scope, the firm, with its nine offices in five continents, provides global insurance programs for U.S.-based businesses, keeping clients informed as to the insurance

requirements of other countries, informing them of legal and regulatory changes, and ensuring that there are no coverage gaps for employees working overseas. Affiliate and founding company, Bartlett & Co. of Leeds, England, recently became a Lloyd's broker, thus creating the possibility for openings for new markets.

July

Operating from four offices in relatively small communities, Ottawa Kent maintains an integrated approach to serving its clients' needs in commercial lines and benefits, including human resources support. It also derives 45% of its revenues from personal lines. The agency was started by the father of Mike Haverdink, current president, in 1973. It grew to 25 employees by 1996, when Mike took over as president, and today has 50 employees. "An insurance policy doesn't make a client safer and healthier. It's what we do as their outsourced risk manager that can do that," says Dustin Boss, Certified Risk Architect and Chief Innovator for Ottawa Kent. To strengthen that risk management effort on the benefits side, the agency set up a division to provide wellness services including education and motivational health coaching. One client, Zeeland Lumber & Supply, found that within a year of establishing a wellness program through Ottawa Kent, its medical-only claims improved dramatically, and there were no lost time claims. "We're already seeing employee morale benefits and financial benefits," says Zeeland President Mike Dykstra. Overall, those clients that have implemented the agency's wellness program have averaged 94.2% employee participation with no financial incentives. Ottawa Kent's substantial personal lines business is supported by a strong automation commitment. "We are completely paperless and have set up 24/7 access to policies for our clients," says Matt Haverdink, vice

president. The agency prides itself on community service—allowing employees two days off per year to help in whatever service project they choose.

August

If you're going toe-to-toe with the direct writers and bank-owned agencies, then you better have the people and tools to demonstrate why your agency is a better option. Jo Ann N. Litwin, president of Litwin Castle, says getting in on the ground floor of agency automation laid the groundwork for growth without having to add employees. The agency has been with the same vendor since 1987. With the agency being an early adopter of technology, its staff is able to "take the extra time to listen to customers and prospects and get the big picture so we can truly tailor a program to meet their risk management needs," according to Vice President Steven P. McCarville. McCarville says the agency works with new clients to close any gaps in their insurance program and identify any new exposures that may necessitate additional coverage. Special emphasis is given to emerging coverages: employment practices liability and cyber liability. A church program started years ago by Jo Ann's dad and a number of other agents across the country is flourishing. The agency insures more than 50 United Church of Christ and Disciples of Christ churches on a master policy. Litwin and McCarville note with pride that they are lifelong residents of Orchard Park. They "give back" by serving on the Orchard Park Village and Town Boards. Litwin's industry involvements include the Applied

Systems Client Network (ASCNet) and ACORD "so I could learn from my peers what they were doing to improve the efficiencies at their agencies."

September

When Peter Bakker's well-known altruistic tendencies caused him to lend a helping hand to a hurting direct writer agent who had lost his market, the agent profited, but so did Peter and all of the agent's clients who had been left high and dry. Because he always had put policyholders first, Bakker reached out a hand to them indirectly by listening to the "homeless" agent's plea for help and taking him in as an affiliate, or a subcontractor of his agency. Soon other "homeless" agents sought a new home with the Bakker agency. "We have become an accidental conglomerateur, bringing new blood into the independent agency," says Bakker. The new affiliates found themselves renewing the sales talents that had attracted them to the insurance industry in the first place. The proof in the pudding is that Bakker and Company's property/casualty premium volume has increased from around $14 million to $45 million with the help of its affiliates. But that's not all. The Bakker Agency offers training to acquaint the affiliates with both the independent agency system and the opportunities that abound in their new world of commercial lines. Training helps them learn to submit business to the right company and provide information that will ensure a quick acceptance of an application.

The result? Re-energized agents eager to produce, and a diverse group in which at least six languages are represented.

October

William E. Underwood's attractive business plan and a reputation for following through on commitments helped propel his fledgling business, Ironwood Insurance and Employee Benefits, to profitability within three years of its 2007 founding. Underwood's previous reputation within the insurance industry helped him raise capital, attract companies, and land a Fortune 500 account that operates in 25 countries. Recently, the agency moved into the benefits field by forming Ironwood Benefits Advisory Services, thus increasing opportunities for cross-selling and providing valued-added services, such as wellness programs, to clients. In addition, Ironwood has partnered with a payroll and HR consulting firm to serve both clients and other businesses. As of this year, Ironwood can boast of $6 million in revenues and 23 employees, eight of whom are owners. Underwood points out, "Every person at the agency is there to support clients. They all are producers or customer service people first and managers second, so they see the management position as being supportive of the agency's primary goal, which is to serve clients." Ironwood's reputation for excellence is not built completely on service and profits, however. From the beginning, it allocated 1% of top-line revenues to charity—even before the firm had achieved profitability. "I wanted the

agency to do the right thing immediately," Underwood notes. "This is a good thing to do for the community we serve and indirectly has helped us grow our business as we have become known as a company with a heart."

November

"The way you win a client is the way you'll lose that client," says John Basten, CIC, CWCA, CRA, risk navigator with The Mid-State Group in Lynchburg, Virginia. That was a hard lesson that John learned when he finally had the opportunity to land a large client. "A business owner gave me the opportunity to quote his business," John remembers. So he sharpened his pencil, shopped the business, and was able to cut the price for the business while nearly doubling coverage. He got the business, but then lost it when "someone came in with a quote that was lower." That was the wake-up call that started the agency on its path to become a unique resource for clients. The agency created a process, Mid-State GPS (Growth Positioning Strategies), that focused on helping business owners decrease costs, increase profit, and create a thriving workplace. It completely changed the conversation. "Now we talk with clients and prospects about growth projections and driving down costs." And that conversation includes at least three Mid-State team members, depending on the expertise needed.

Mid-State has truly gone "Beyond Insurance" by adding experts who can partner with clients in areas such as HR compliance, safety training, wellness and finance. In fact, one client actually uses Mid-State's director of finance as its outsourced CFO! By transforming itself from an insurance sales organization to a risk management and consulting agency, Mid-State has transformed its relationship with clients from vendor to partner—and no one fires a partner.December

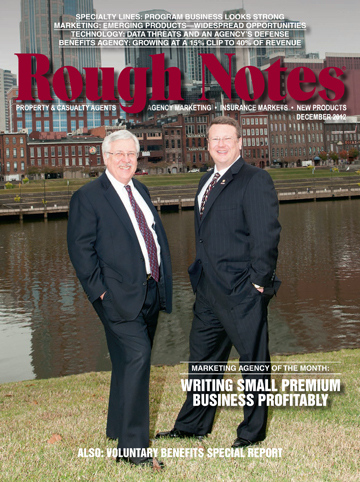

December

A commitment to automation has created a big presence for this small agency as Founder Chester Butler constantly looked for ways to serve his customers as quickly and efficiently as possible. Coming out of the world of bonding, Chester initially focused on that area, as well as commercial insurance. And, when he was exposed to the Internet at a PIA meeting in the early '90s, he recognized an opportunity. The first step was a Web site, "but it became clear to me that the Internet could be a much more valuable tool for marketing and selling insurance," Chester notes. This became especially valuable for small bonds like those written for notary publics, where profits were dependent on writing a large number of accounts. After getting the support of Western Surety, the agency set up a Web site, www.bondyourself.com, to write bonds online and it worked, putting the agency ahead of the curve. "No one else was using the Internet to write this business, so we pretty much had it all to ourselves." When son Brad joined in 2000, he quickly realized that there was "an opportunity for us to reach potential customers over the Internet." The problem was finding a way to "present solutions to complex risks in an understandable and readable way," Brad continues. "What we came to realize was that the best way to do that was simply by focusing on one aspect of a particular risk. And, as we continued to provide additional

blogs on different aspects of risk, we began to develop a following of individuals and businesses that recognized us as experts."

|

||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||

| ©The Rough Notes Company. No part of this publication may be reproduced, translated, stored in a database or retrieval system, or transmitted in any form by electronic, mechanical, photocopying, recording, or by other means, except as expressly permitted by the publisher. For permission contact Samuel W. Berman. |