|

|

|

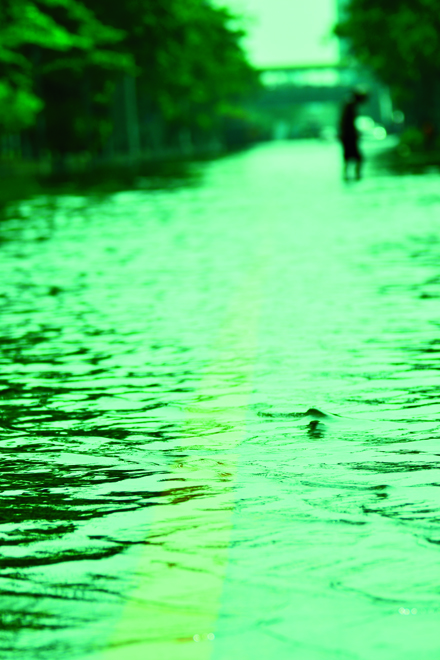

ART market overview: Post Hurricane Sandy Property loss trends provide new reasons to seriously confront climate change

By Michael J. Moody, MBA, ARM Even before Hurricane Sandy made landfall on the Jersey coast on October 29, 2012, it had pummeled a number of Caribbean islands, including Haiti where it laid waste to the island once again. Rates in the commercial property and casualty insurance sector were already poised to start encountering some price strengthening in 2013. Several lines of coverage, most notably workers compensation, some specialty liability coverages, and coastal property were already headed for higher rates. However, since Sandy, the pricing picture has changed dramatically. While the final tally from Sandy is still not complete, most industry experts expect that there is adequate capital within the insurance industry to "weather the storm." Current loss estimates appear to be in the $50 billion to $60 billion range. According to S&P, "Despite continued uncertainty surrounding the final insured loss estimates for Superstorm Sandy, Standard & Poor's Ratings Services believes that the reinsurance sector's strong capital and very strong earnings thus far in 2012 will allow it to withstand losses well outside the range of current estimates." At that loss level, Sandy is well below Katrina's $135 billion record-setting figure, but it will certainly be one of the top five U.S. loss events of all time. However, it is the long-term trend that many find problematic. The Insurance Information Institute, for example, notes that "natural catastrophes and their resulting costs have been steadily rising in the U.S. over the past two decades." Many other industry information reporting organizations indicate similar concerns. ART market implications Overall, the alternative risk transfer (ART) market has been in a growth mode for quite some time, despite the super softer commercial insurance rates of the past 10 years. The increasing ART activity has been largely in the middle market, as mid-sized companies begin to see the value of controlling their losses and reaping the benefits from the reduced claims. While the majority of mid-sized businesses are still looking to group captive solutions (association captives, cell captives, risk retention groups, etc.), more of these firms are exploring "going it alone." Some of the attention is now being focused on microcaptives [831 (b) captives] with significant growth occurring over the past 12 to 18 months. Typically, single-parent captives have been more directed at larger, Fortune 500 companies; however, through the use of a microcaptive, smaller organizations can also utilize the single-parent captive structure. These are specifically designed to allow smaller corporations, those with a maximum annual premium of $1.2 million or less, to form a single-parent captive. These captives are usually formed to provide coverage for uninsured risks such as product recall, cyber liability, patent infringement liability as well as key man coverage. Increased usage of these specialty captives should increase markedly as brokers and their prospects become more comfortable with the concept.

However, it is not just commercial businesses that have seen a growing trend regarding ART market products. The insurance sector itself has also been actively considering the viability of ART products such as catastrophe bonds (CAT bonds), and other forms of insurance-linked securities (ILS). According to a recent survey undertaken by reinsurance broker Guy Carpenter, there is a growing reliance on ART products by the reinsurance community. In one of the survey questions, participants were asked what sources of capital reinsurers would use in the coming year (2013). While the majority of respondents indicate traditional reinsurance,16% said that alternative sources of capital such as insurance-linked securities, catastrophe bonds and collateralized reinsurance vehicles would be their choice for the year ahead. To date, the majority of ILS issuance has been related to property covers; however, there have also been advancements within the mortality sector of the insurance business. Despite this, the property market continues to dominate the ILS arena. As these products mature and gain acceptance within the insurance and investment community, it would appear that their growth is assured, based on Carpenter's survey. However, since the majority of ILSs deal directly with catastrophic property losses of one type or another, there is one over-riding issue that needs to be noted. Many believe that climate control is in many respects the "800 pound gorilla in the room" that no one wants to discuss. For far too long, the insurance industry, like so many other industry segments, has been all too willing to just "kick the can down the road." But unfortunately that is no longer an option. Climate change and its effects are really at the heart of many of the catastrophic property losses. It has caused a major shift in property loss patterns worldwide. Recent changes in reserve requirements that were directly driven by increasing loss potentials noted by the major CAT modeling agencies was one of the first signs of impending problems. Subsequent to Sandy, many weather experts and news agencies have taken to calling this heightened loss potential the "new normal." Climate change is a polarizing issue with strong feelings on both sides. But regardless of one's position on the matter, some troubling facts are now becoming apparent. Among the most troubling are: • Melting polar caps, which are leading to warmer sea water and increasing sea levels • Mega droughts brought on by increasing air temperatures and lack of rain • Powerful super storms . . . think Hurricane Sandy • Massive wildfires due in large part to dry weather conditions and high winds Taken in total, these conditions suggest that global warming is already here. And while there may be those who disagree that the above suggests climate control efforts are needed, 97% of scientists who publish peer reviewed research on this subject say that global warming is real and, further, it is man-made. Interestingly, the ART market, from the standpoint of both commercial corporations and insurers/reinsurers standpoint, will be among the first to experience the "new normal." Regardless of the vehicle chosen, captive, CAT bond, ILS, etc., the financial results are much quicker to materialize. Thus, it is easy to see why they have the most at stake in this "new normal" world. Involvement with the capital markets in one form or another in all likelihood will become mandatory as catastrophic losses slowly suck the capital and surplus from the traditional insurance sector. Conclusion Market hardening will certainly stimulate an increased interest in ART products. Corporations of all types and sizes that have not chosen to use captives previously will, in all likelihood, begin to consider their feasibility. Mid-sized commercial corporations will lead the way with this movement; however, even Fortune 500 type organizations that have not been using captives as part of their long-term risk management strategy will begin to consider their viability. Insurers/reinsurers will also begin a similar feasibility phase. In some respects the emergence of ART products (CAT bond, ILS, etc.) in the insurance industry is similar to the ART movement in the commercial insurance market. Fifteen to 20 years ago, those corporations that utilized captives were considered "cutting edge," but today they are considered common place. A similar transition, albeit much faster, will likely occur in the insurance sector, as the "new normal" becomes a continued reality. Sustainability of the insurance industry as we know it will depend on the capital markets providing a new source of needed funds.

|

||||||

| ||||||

| ©The Rough Notes Company. No part of this publication may be reproduced, translated, stored in a database or retrieval system, or transmitted in any form by electronic, mechanical, photocopying, recording, or by other means, except as expressly permitted by the publisher. For permission contact Samuel W. Berman. |