|

|

|

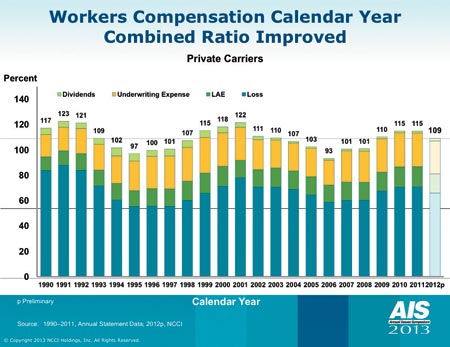

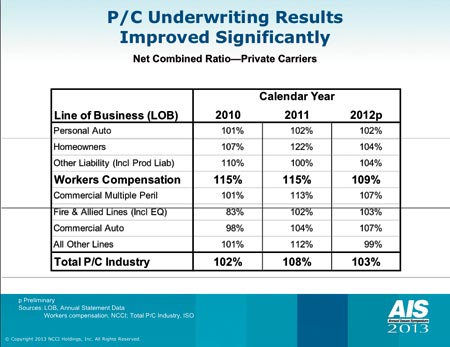

NCCI meeting continues to excel The cycle in comp has turned, chief actuary reports By Dennis H. Pillsbury The National Council on Compensation Insurance has done it again. The Council's 2013 Annual Issues Symposium continued the tradition of being one of the best industry meetings, providing timely and useful information in a short period of time. And, probably its greatest claim to fame, the chief actuary's report on the State of the Line, remains a well-attended highlight. How many meetings can boast an SRO crowd for an actuarial report? NCCI President and CEO Steve Klingel kicked off the meeting titled "Walking the Tightrope to Recovery" by reporting some "really good news": The combined ratio for the workers compensation line dropped six points in 2012, "moving us along on the tightrope" toward that platform where "all constituents in the workers compensation system are getting their needs met." Noting that the six-point drop came off of a 115 combined in 2011, Steve commented that the "only dark cloud is that 109 is not good enough to get us to that platform." (See Chart 1.)

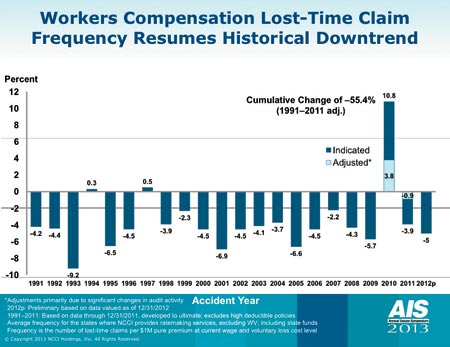

Some more really good news, he added, was the fact that lost time frequency resumed its downward trend. In 2010, frequency was up and there was concern about whether this was an "aberration or a new normal." The latest results make it clear that it was an aberration, Steve noted. (See Chart 2.)

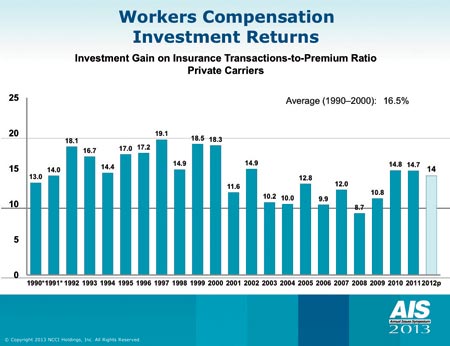

On the other side of the coin was the slowly shrinking investment gain, which remained at a healthy 14%. "But it is shrinking slowly as bonds with higher yields mature and that money has to be invested in lower-interest instruments," Steve noted. (See Chart 3.)

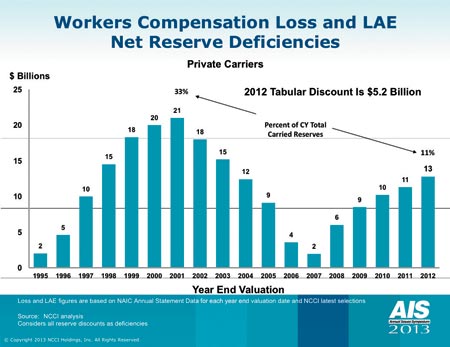

He also pointed to a "disturbing trend" where reserve deficiencies rose to $13 billion, noting that the "deficiencies have grown by $1 billion every year since 2009 and last year, grew by $2 billion. Let's face it, it's not going to help us at all if much of our gain on the combined ratio is simply because we are failing to recognize adequate reserves." (See Chart 4.)

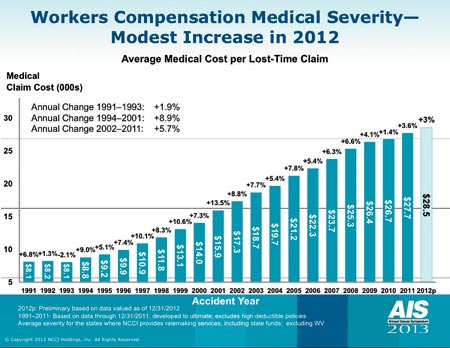

Medical inflation improving With medical costs now accounting for 60% of workers compensation premiums, it is clear that they are an important part of the equation, so the fact that the rate of growth in medical severity is on the decline is good news, Steve said. Total health care spending overall has seen slower growth, with the increase in workers comp health care claims costs rising only 3% in 2012. (See Chart 5.)

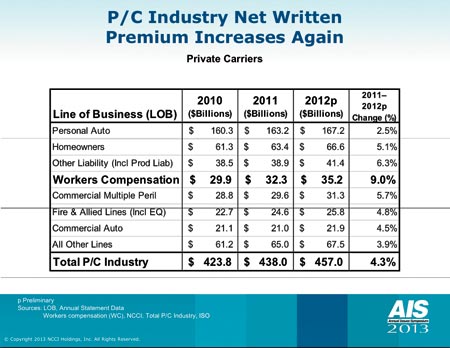

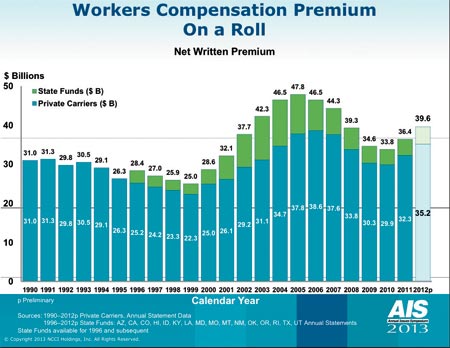

Steve continued by looking at some of the factors that have helped to ameliorate inflation in the health care sector, specifically as regards workers compensation. He pointed to the adoption of fee schedules, noting that physicians' fees, which account for about 40% of workers compensation medical costs, were subject to fee schedules in only 14 states in 1970. Today, 44 states have physician fee schedules. Hospital fee schedules now exist in 38 states, compared with 2 in 1970. What has been "a very good story," he continued, is that there was a noticeable decline in the prescribing of narcotic painkillers in 2012. He concluded by pointing out that this is "all good news, but we need to keep paying attention." He noted that because medical has become such a critical part of the workers compensation equation, it could eradicate the industry's operating gain by 2017 if its inflation rate remains at the same level and all the other factors remain the same. If the medical inflation rate increases, he warned, it could be very problematic. All that being said, Steve, with a sense of the dramatic, finally announced the descriptor for the workers compensation market: It is "encouraging." Most things are heading in the right direction. The state of the line Picking up immediately on Steve's conclusion and the "word of the year," Chief Actuary Dennis Mealy, FCAS, MAAA, reported that 2012 showed some "encouraging signs for the industry." He noted that the workers comp industry had experienced "tepid results" since 2007, but 2012 was the "third straight year of premium growth," and workers compensation led all lines, posting premium growth of 9.0%, while the industry overall showed growth of 4.3%. (See Chart 6.)

Overall the property/casualty industry enjoyed a five-point improvement in its combined ratio, down to 103, boosted by "weather that was generally kinder" so that property-sensitive lines like homeowners and commercial multiple peril saw some dramatic drops. (See Chart 7.)

He summed up the state of the total property/casualty industry by noting that surplus had grown to a record of $587 billion, while premiums rose to $457 billion, placing the premium-to-surplus ratio at a "very robust" 0.78:1. Turning to workers compensation, Dennis pointed out that the 9% premium increase was helpful, but "we're still not quite back where we were." (See Chart 8.)

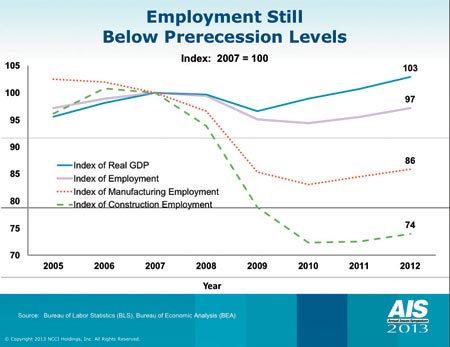

He noted that two sectors—manufacturing and contracting—still are lagging behind the general recovery, and these sectors "represent around 30% of our premium." While GDP has finally recovered to a point where it now is 3% ahead of 2007 levels, he noted, employment still is at 97% of 2007 levels; and manufacturing (at 86% of 2007 levels) and contracting (at 74%) are pulling this number down. (See Chart 9.)

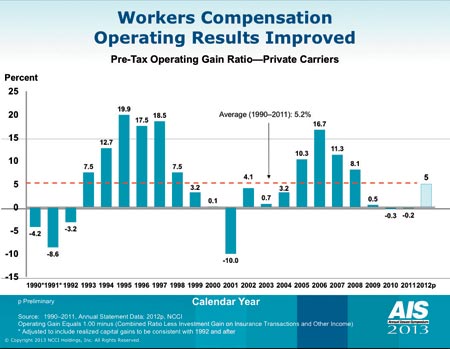

He went on to note that manufacturing has been declining for about 40 years because of improvements in productivity and mechanization. "I view this as similar to agriculture in the last century where one-third of the population was employed in agriculture around 1900 but by the end of the century that number was around 2%." Turning to contracting, he pointed out that it was growing prior to the recession and "we're starting to see a little growth, but until the housing market recovers, we probably won't see a significant uptick in contracting." The cycle has turned Turning to the "best combined ratio since 2008," Dennis concluded that the "cycle has definitely turned in comp." He noted that the peak of 115 is a little lower than in previous cycles and the turnaround came one year sooner than in previous cycles. "The cycle is a little shorter and flatter," he said, adding that he believed that occurred because of the low yields on investments. "It's a little hard to get excited about cash flow underwriting in this investment environment," he commented. The turnaround in the cycle is clearly displayed by the operating results as is the cyclicality of the workers compensation business. The workers compensation industry posted a 5% operating gain after three years of flat results. (See Chart 10.)

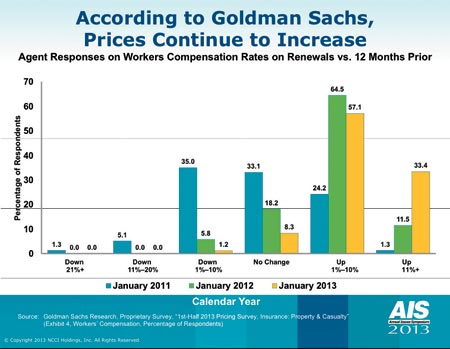

"That's the best results since 2008," Dennis said, and is right on the average operating gain for the industry. The chart, he continues, shows that "in many ways, workers comp is a boom and bust kind of line. We make a lot of money and then we find ways to lose it, then we make it back and lose it again." He paused and then pointed out that in his tenure at NCCI "I've been striving for stability. I guess it's time to retire," he added, with tongue in cheek since he had announced his retirement earlier. Turning to pricing as yet another indication of the turn in the cycle, he noted that a recent Goldman Sachs study makes it clear that no one is getting a lower rate for comp. (See Chart 11.)

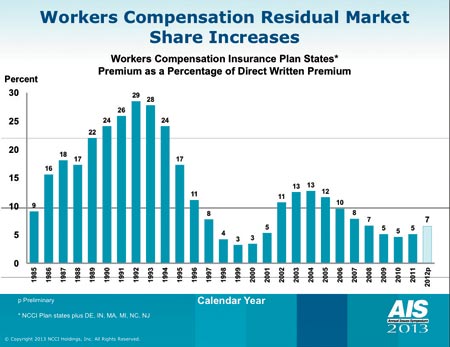

At the same time, the residual market is starting to grow; premiums rose from about $500 million in 2011 to $800 million in 2012, so the residual market now has a market share of around 7%. (See Chart 12.)

"My gut feeling is that this will edge up and could get as high as 10%," Dennis commented, noting that now that he was retiring, he could make predictions without fear. He continued that the residual markets, thanks to the fact that they now are self-funded, are in good shape. Their combined ratio improved to 112 in 2012 from 117 in 2011, and the underwriting losses from the residual markets amounted to about $99 million in 2012, an amount that is manageable for the traditional industry that has to absorb those losses. Summing up, Dennis appeared quite sanguine about the future for the industry. The premium increases and the frequency decline in lost time claims as well as the amelioration in the medical loss inflation was good news. And the industry's capital position was excellent. However, he remained cautious about overall improvement as the underwriting results were still not as good as they needed to be and the general economic recovery continued to be slow. All in all, the results indeed are "encouraging," but the industry still has a long way to walk on that tightrope if it ever plans to land on that platform where "all constituents in the workers compensation are getting their needs met." The next few years should be quite interesting.

|

||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ©The Rough Notes Company. No part of this publication may be reproduced, translated, stored in a database or retrieval system, or transmitted in any form by electronic, mechanical, photocopying, recording, or by other means, except as expressly permitted by the publisher. For permission contact Samuel W. Berman. |